| The U.S. national debt is projected to hit $20 trillion exactly 212 days from today... That's April 1, 2017. According to estimates from Brillig.com, American debt has increased an average $2.39 billion a day for the past three years. Using these estimates, the national debt will cross the $20 trillion mark on April Fools Day, 2017. Now, it's ultimately irrelevant whether or not the U.S. national debt will cross $20 trillion exactly on April 1, 2017. It is, however, vital for you to own gold well before that debt figure is reached. And that's simply because whenever it actually happens (on, before, or after 4/1/17), the U.S. national debt crossing the $20 trillion level will be both national and international news. | Advertisement | | Tesla's CEO Accidentally Reveals a Big Secret Investors have been desperate to learn where Elon Musk plans to get his future lithium supply. The thing is, he just accidentally let the answer slip recently! And that means early investors can turn $5,000 into an easy $90,000 from Musk's slip-up. You can watch his incredible video footage HERE. | Here's a parody of the future Drudge Report headline in advance...

We also have to consider that crossing $20 trillion is a key psychological level. It's an easy figure to remember, and I expect to hear it repeated for months after actually crossing $20 trillion, as the number makes its way from headlines to barstools. The national debt will be an issue the next president will be forced to address. And it will continue to both cast further doubts on the U.S. financial situation and erode confidence in the Federal Reserve. A recent piece by Jon Hilsenrath in the Wall Street Journal, titled "Years of Fed Missteps Fueled Disillusion With the Economy and Washington," showed the Federal Reserve has been dealing with an overall crisis of confidence since the turn of the century. The article says: ... confidence in the central bank’s leadership has dropped. An April Gallup poll found 38% of Americans had a great deal or fair amount of confidence in Ms. Yellen, while 35% had little or none. In the early 2000s, confidence in Chairman Alan Greenspan often exceeded 70%.

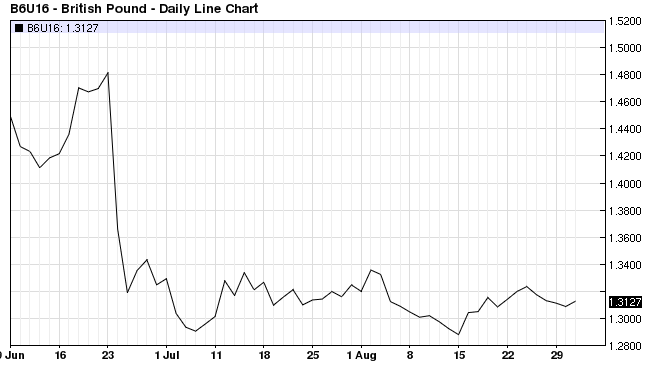

News of the U.S. national debt will continue to erode confidence in the Fed's ability to conduct sound monetary policy, as well as in all American financial institutions, including the U.S. dollar. As a result, there will no doubt be a run to safe haven assets — particularly gold, which is ultimately the basis of all labor storage. | Advertisement | | 26 times MORE money in 8 minutes... Most people who collect dividends have to sit around and wait for quarterly payouts. And even then, the money they make often amounts to almost nothing. However, thanks to something called "daily dividends," that's all changed. In short, you could be collecting daily guaranteed payouts of $495, $755, even $1,484. As Forbes recently said of this stock market secret, it's "like finding money in the street." Click here and find out about the "daily dividend" that's available RIGHT NOW! | I suspect the Federal Reserve will actually be working to contain the value of the dollar at this point as it discusses the next move. An overly strong dollar can cut into profits as U.S. products for exports become more expensive. And the Fed wants to do everything it possibly can to support GDP. Fed members have also stated on numerous occasions in the past several weeks that inflation is below their target. In other words, they want to inflate. I suspect that some of the recent strength in the U.S. dollar is still the result of Brexit. The British pound has not recovered a bit since.  |  | | Click to Enlarge | So, even at current levels, I think gold is a very strong buy right now. Going forward, the U.S. national debt crossing $20 trillion will be big news, both nationally and internationally. This will no doubt spur interest in gold as a safety hedge all around the world. And it's something you should preempt by owning gold today.

Luke Burgess

Energy and Capital | Advertisement | | This emerging technology just handed early investors

over 4,985%... and it's getting ready to do it again At this very moment, an emerging technology is taking the world by storm, changing lives, and making early investors rich. In fact, one stock just soared from $10 to $500, handing savvy investors a whopping 5,000%. That's good enough to turn a $25,000 investment into $1.25 million. The best part? This is only the tip of the iceberg. In fact, in the following video, I'll show you three stocks that have absolutely explosive upside potential and the ability to turn every $1 you invest into $10... $25... even $50 or more. Click here now to learn about these three stocks. | |

No comments:

Post a Comment

Keep a civil tongue.