Before we get into the quick essay below, I want to highlight something important. |

What you're about to read generated one of the strongest reactions of the entire year. It produced a surge in clicks, replies, and questions, yet a large portion of readers never saw the first send. |

That matters because the environment we're tracking is creating real and measurable opportunities. |

Copper is breaking out. Miners are confirming the move. The demand from AI and Nvidia is accelerating. And the deeper, more powerful driver from emerging markets is now building beneath the surface. |

Two of our premium recommendations crossed the 100% gain threshold and have officially activated the Moonshot Ride. |

These are positions that doubled inside an eight-month window, and they join two earlier winners that also doubled this year. |

That's four doubles in 2025 due in part to this massive trend we're covering below. And every one of them was sent first to Premium Members. |

You will always make your own decisions, but I want you to have the full picture. |

When you act early in cycles like this, the upside and the timing work in your favor. |

When you follow the trend late, the window has already narrowed. |

The difference between those outcomes often comes down to the insights that Premium Members receive before the broad audience sees the results. |

The essay below explains the setup. From the demand shock from Nvidia and the supply stress in copper, to the long-term engine from emerging markets that most investors are not paying attention to yet. |

If you've been considering Premium, this is the moment when it makes the most sense to join, because the metals cycle is only beginning, and the next phase tends to reward those who position early. |

For those who already subscribe, your Moonshot Ride instructions are included at the end so you can lock in your gains. Congratulations to everyone who got in those positions early with us. |

Original Essay: |

|

When Nvidia reported earnings last month, our essay covering the story on it became one of the most opened and clicked editions of the year. |

Everyone instinctively understood that Nvidia's numbers were part of a much bigger story. |

A story that weaves in global infrastructure, an outdated grid, rare and common materials, and, finally, what many don't yet fully appreciate: a copper story. |

Copper's recent breakout is the second half of that same Nvidia message. But there's something most people are missing. |

Nvidia is enormous. AI is enormous. The data center buildout is enormous. And none of them are the biggest driver of what happens next. |

Nvidia showed the demand shock. Copper is showing the supply shock.

|

Nvidia's earnings revealed a world racing to build AI capacity. |

Hundreds of billions are flowing into data centers. |

Every one of those facilities requires copper at every stage of the power chain. |

And because copper is such a tiny slice of data center budgets — under 0.5% — developers barely notice the price. It's a rounding error, and they buy whatever they need at whatever the cost is. |

That's why a rapid building surge can yank copper prices up 15% or more in a short window and drain already weak inventories almost overnight. |

This surge is one of the reasons why copper is breaking out in real terms. |

It's also why miners are outperforming the metal. |

And finally, it is why our October Moonshot Minute copper-miner recommendation is already up just over 15% after yesterday's close. |

But even this is just the surface. |

AI demand is real… but unpredictable. EM demand is not.

|

This is the part most miss. |

Even if AI slows… Even if data center expansions take a breather… Even if the "AI bubble" cools off… |

The copper story does not weaken. According to the research we're following, it actually becomes an opportunity. |

Why? |

Because AI is not the primary driver of the copper cycle, emerging markets are. |

Electricity consumption in EMs has already tripled since 2000. It will grow by another 30% by 2035 and nearly double by 2050. |

These countries will account for 65% of global GDP growth over the next decade. And copper demand tracks those curves upward like a shadow. |

India and Southeast Asia alone could add 3.3 million tonnes of new demand by 2035. If their development path even partially mirrors China's rise, the figure climbs past 5 million tonnes. |

That demand is structural, and it isn't optional; it also doesn't depend on an AI boom. |

Which means that while AI accelerates the trend, emerging markets anchor it. |

The supply deficit is locked in

|

Copper is breaking out because the world simply cannot supply what the future requires. |

Consider the following: |

New supply costs $23,000 per tonne of annual capacity Some projects run closer to $30,000 A mid-sized mine requires six billion dollars before production begins Major disruptions have already wiped out expected surpluses

|

The commodity wave is widening

|

The same forces pushing copper higher are lifting other metals tied to electrification, monetary stress, and global infrastructure. |

Two of the recommendations we shared with Premium Members earlier this year just crossed 100% gains. |

They have doubled in less than eight months. And they join two earlier winners that also doubled. |

That's four different Moonshot Minute recommendations in 2025 where following our premium research would have doubled your money. |

In a cycle like this, when a position doubles, it activates the Moonshot Ride framework. That is where the upside gets unlocked because we sell our initial capital and we ride the rest with house money. |

Congratulations to all the Premium Members who took advantage of these big winners. My team and I will continue working hard to make sure 2026 hands us even more winners. |

Premium Update |

Today's premium update explains: |

The two newest 100% winners Why both have now triggered a Moonshot Ride How this ties into Nvidia's demand shock Why copper's breakout is the stronger, deeper, longer-lasting signal And how emerging markets quietly set the floor under this entire commodity cycle

|

Nvidia showed the world where demand is heading. Copper is showing what the future will cost. |

But emerging markets are showing why the cycle has years left to run. |

This is how big secular winners form, and this is why you want to be early, not late. |

If you haven't joined Premium, I urge you to consider it today. It's up to you to decide and I've made it as easy as possible for you to join should you choose to. |

And if you are a Premium Member, keep reading below for the two recommendations we're taking 100% gains on. |

Double D |

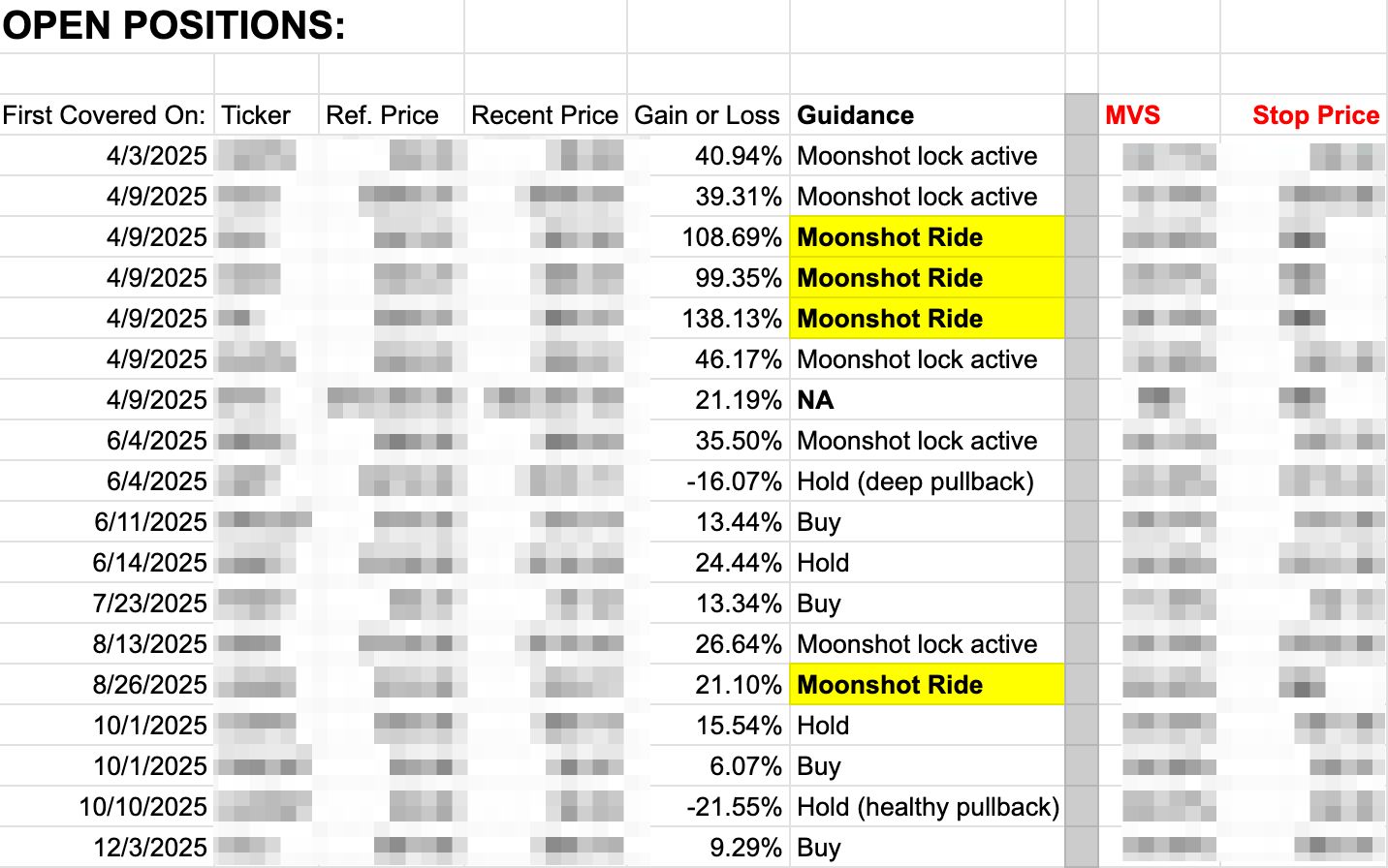

P.S. Here's our current open portfolio with the tickers blurred out since that's only for Premium. As you can see, of the 18 open positions, all but 2 are up, and many are still in buy range: (keep scrolling down for the Premium Section) |

|

🔓 Premium Content Begins Here 🔒 |

|

In today's Premium Section, you'll find a TWO brand new recommendations that hit our Moonshot Ride. What that means is they both have hit at least a 100% gain. Congratulations to all the Premium Members who got in. | I hope you've been paying attention because many of our picks are currently beating the S&P by up to 4-to-1 this year. | Most financial newsletters charge $500, $1,000, even $5,000 per year. Why? Because they know they can. | I don't. | I built my wealth the old-fashioned way, not by selling subscriptions. | That's why I priced this at $25/month, or $250/year. | Not because it's low quality, but because I don't need to charge the typical prices other newsletters charge. | One good trade, idea, or concept could pay for your next decade of subscriptions. | The question isn't 'Why is this so cheap?' The question is, 'Why would I charge more?' | 👉 Upgrade to Premium Now | P.S. If this newsletter were $1,000 per year, you'd have to think about it. | You'd weigh your options. You'd analyze the risk. | But it's $25 a month. | That's the price of a bad lunch decision. | And remember, just one good idea could pay for your subscription for a decade. | 👉 Upgrade to Premium Now | |

|

|

No comments:

Post a Comment

Keep a civil tongue.