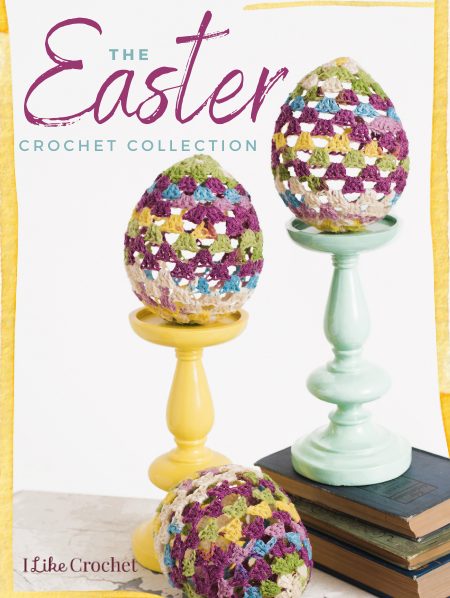

| Hop into almost two dozen adorable Easter crochet projects! Become an I Like Crochet Gold Member now to get instant access to these wonderful patterns and hundreds more! Dear Classic Friend, Easter is a time to put on something new and special — a festive sweater, an adorable hat, maybe a light and fresh springtime scarf. It's also prime time for gifting: Easter baskets, bonnets, bunnies, eggs, and more! Our Easter Crochet Collection is overflowing with project ideas. Let's get started! The body gets its roomy shape by switching to a larger crochet hook and double crochet after working six rows of single crochet. After the body is complete, a simple two-row edging finishes off the opening. Some Bunny to Love When it comes to cuteness with a high cuddle factor, Petunia the Pillow Buddy Bunny is a hands-down winner. She's a pillow. She's a buddy. She's super colorful and cuddly. Petunia will be lounging around long past Easter, with her colorful striped belly, fun floppy ears, and adorable face. For all her cuteness, Petunia is an easy project to make, and fits a standard bed pillow. For the youngest bunnies among us, make this adorable hat had diaper cover set. The Bunny Hop Set is just what baby needs for an extra "hoppy" Easter. This pattern is rated Easy and the pattern accommodates sizes from newborn through 6 months. Prepare for extra cuteness! Every bunny needs some bunny sometimes, and Bailey the Bunny is the perfect bunny companion. This amigurumi bunny sports pastel dots on his ears and an egg motif on his belly. He's the perfect Easter basket companion. Our Jelly Bean Bunny is easy to make and easy to customize with your favorite colors. This little bunny looks good enough to eat — but surround him with some jelly beans and other Easter treats and let him enjoy the day, complete with his own carrot. Why buy treat bags when you can make some that will last? Our Sunny Bunny Bag is a stylish little drawstring bag with a bunny face and tall, perky ears. Fill with treats for Easter and watch the smiles all around! If you need a bag for smaller treats or a special little gift, make our Baby Bun Version of our Sunny Bunny Bag. The bunny ears and adorable little bunny face are the perfect mini-me of our Sunny Bunny Bag. You may have to make both — they're just so cute! Hop into Spring Fashion As the seasons change, so do our fashion choices. Step out in style and comfort in our Pretty in Peplum Top. This timeless design will keep you looking pretty as you head out for a stroll or welcome guests to afternoon tea. The flowing peplum adds breezy movement to this top — it's a piece you'll want to wear often! When you need a little something more to add style than take off the chill, our Dusk Daisy Cardigan is just the thing. The beautiful piece is worked in floral motifs that you join as you go — no final sewing required! Its wide, square neckline and elbow-length sleeves make this classic top the perfect spring fit. When you need something a little warmer, got for our Serene Spring Long Cardigan. The easy stitch pattern creates a lovely flowing fabric, and a simple single crochet edging gives this sweater a classic, elegant feel. Perfect for a walk in the park or time curled up by the fire with a book. We may be waving goodbye to winter, but that doesn't mean the end of scarf season. Celebrate spring with our light and airy Abigail Striped Bias Scarf. You'll love its lighter-that-air feel with its row of bias-worked eyelets. The hardest part will be choosing your ideal color combination! Bring Spring Home Bring back memories of childhood with the adorable Duck, Duck, Goose! Baby Blanket. Crocheted in the round, with intriguing textures and alternating festive colors, this blanket will be home for 18 cheerful ducks swimming around a goose at center stage. This is definitely not your basic baby blanket. Make it for someone special! If you need a baby blanket more on the low-key side, make our Spring Awakening Baby Blanket. Also worked in the round, the pattern is easy to remember. And when you get to the edge, this blanket features a lovely understated lacy border. Wouldn't it be nice to have an Easter basket that would last? Well, you can make a whole set of baskets in different sizes! Our Blooming Baskets Set has directions for a small, medium, and large basket that you can use throughout the year, or save especially for Easter. The graduated baskets nest together for easy storage. Add some extra decoration to each basket with a thread granny square embellished with your choice of flower motif. An Easter basket requires Easter eggs, and you won't find more adorable additions to your Easter basket than our Egg-cellent Granny Stitch Eggs. This crochet version of the classic Fabergé egg gets its shape from working the stitches around a balloon, adding stiffener, then gently popping the balloon — but you don't have to share that secret! When it's time for Easter brunch, decorate the table with our Simply Blooming Placemats. You pick the color combination that works for your table. Add a little flower at the corner to welcome spring and keep the table festive! And when it's time to kick back and relax, enjoy the bold sprinkling of flower motifs on our Bloom Brilliantly Pillow. Give a plain old throw pillow new life with this colorful project that you attach with a simple whip stitch when you're done. These flowers won't fade! For Your Little Bunnies We have your little bunnies covered from head to toe in this set of patterns. Take a basic long-sleeved tee a step closer to cute, and you have our Bubble Gum Bows Top. It features adorable bows worked into the sleeves and the back, giving the top a super sweet look. Once you make one, prepare to make more. This is a popular pattern! The Buttons and Bows Dress is a perfect little baby dress, complete with decorative buttons and sewn-on bows. Crochet it in your choice of colors. With its lovely lines and adorable short sleeves, this will be a winning outfit for spring. When little baby feet need some pampering, our Marshmallow Sandals are just the thing. Add a little flair to their favorite outfit with these comfy, ruffle-edged sandals. Want to make a custom Easter basket for a special someone? Our Eggcellent Easter Basket is a breeze to make, complete with a little ruffly flower and wide, kid-friendly handle. It's just the perfect size for an egg hunt and to hold plenty of treats! Of course, an Easter bonnet is always a fun accessory to have, so why not make it adorable? Our Spring Baby Pixie Bonnet is totally customizable for your favorite little pixie, and the flower embellishment adds a perfect finishing touch. And when you want something practical and adorable, make a pair of Robin's Eggs Beanies — one for each of you. These sweet beanies feature delicate eyelets and a fashionable roll-up brim. Look cool while you ward off the early spring chill in style! There's so much more in our Easter Collection than can fit in one basket. Where will you start? |