| |

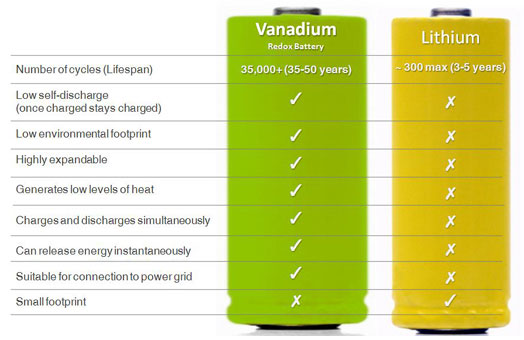

| Wanted: Vanadium Supply By Nick Hodge | Friday, December 2nd, 2011 A little-known metal used in steelmaking could emerge as a game-changer for battery technology, raising the prospect of an investment boom like the one that lifted rare earths out of obscurity last year. Those aren't my words. They're Reuters'. The opportunity the straitlaced news organization is describing is so exciting, its description almost sounds sensationalized... It's not. Advertisement Mining Will Never Be the Same Nobody ever thought these rare earths and precious metals would see the light of day. But that's about to change, thanks to one tiny explorer's game-changing technology. In fact, it's already made select investors 500% richer. And it could make you 744xs your money. Get the whole story right here. Another Metal to Learn The metal in question is vanadium. And according to Chris Berry, founder of New York-based research firm House Mountain Partners, the potential exists “to make vanadium into a multi-billion dollar metal.” Its strengthening capabilities have been known for years... Henry Ford added it to steel to build the Model T. It's also used to create specialty alloys for the aerospace industry. But those uses aren't what's going to turn vanadium into a multi-billion-dollar metal... Energy is. Wanted: Vanadium Supply Vanadium flow batteries charge in a flash, their capacity actually expands, and they last for decades. But until recently, vanadium's volatile price has kept most manufacturers from working with it. Reuters reports: “At present, vanadium prices tend to surge when steel demand is high and plummet during economic downturns. The volatility is a major deterrent for battery producers.” A new willingness to invest in vanadium battery technology could mean a new use for the metal — and something to help stabilize prices. China-based Prudent Energy recently raised $30 million in an effort to reduce the costs of its vanadium batteries. It's rumored that China Strategic Holding is spending $300 million to build the world's largest vanadium battery. German start-up DBM Energy has made a lithium-vanadium car battery it says can travel 375 miles on a six-minute charge. For comparison, the Chevy Volt can only go 50 miles on a four-hour charge. Two major international automakers already have plans to adopt the technology. According to Byron Capital Markets analyst Jonathan Lee, “You're seeing dollars flow into this technology, so there is some good promise in it going forward. "In the long term, the demand will rise.” Advertisement East African Nation about to become Trillion-Dollar Economy Today, its GDP is just around $40 billion... but in a few short years, this number could grow by a factor of 100. And it's all because of a fossil fuel deposit — one of the biggest ever discovered. Find out who just bought this property — and the staggering resource they're about to pump out. The Next Rare Earth Scenario? Economics tells us vanadium prices will level off if the early scramble to secure a stable supply gains traction, much like the recent rush to find rare earths. You should know by now the companies that found rare earths surged by tens of thousands of percent. American Vanadium (TSX-V: AVC) CEO Bill Radvak is certainly excited: "Vanadium has all that rare earth-type opportunity, yet it has a very stable base on the steel-strengthening side, It's just about to take off in the next year or two." His company owns a deposit in Nevada, and is looking to partner with battery makers to sell them vanadium at a lower price while sharing profits from the value-added battery. Largo Resources (TSX-V: LGO), Apella Resources (TSX-V: APA), and Energizer Resources (OTC: ENZR) are some other names to watch. For my money, I like the company I just visited in Canada... It has a proven reserve of 257 million pounds of recoverable vanadium oxide. At current prices, that's worth over $2.1 billion dollars. That's impressive — because the metal in the ground is worth several hundred times the company's current market cap. And it isn't just vanadium this company controls... It also owns millions of pounds of nickel, uranium 308, lithium, and a full suite of rare earths. I knew it was going to be a massive opportunity — a real shot at a ten-bagger — so I brought my video camera along. You'll be shocked to see how much metal wealth is sitting in this property. The vanadium is only the beginning. Call it like you see it,

Nick Hodge Related Articles Vanadium: The Best Thing Since LithiumAlberta Black Shale Massive Mine in Canada The Horn River Shale Basin From the Archives...SolarCity's Military Project Moves Forward2011-11-30 - Brianna Panzica Discovery off the Southeast African Coast 2011-11-30 - Brianna Panzica Trade Is More Profitable Than War 2011-11-30 - Jeff Siegel The Oil Field May Contain Up to 30 Trillion Cubic Feet of Natural Gas 2011-11-29 - Cori O'Donnell What's It All For? 2011-11-29 - Nick Hodge Economic Releases for the week of Monday, December 5th, 2011: Dec 05 - ISM Services Dec 07 - MBA Mortgage Purchase Index Dec 09 - Trade Balance Dec 05 - Factory Orders Dec 08 - Wholesale Inventories Dec 09 - Michigan Sentiment Brought to you by Wealth Daily | |

| This email was sent to ignoble.experiment@arconati.us . You can manage your subscription and get our privacy policy here. Energy and Capital, Copyright © 2011, Angel Publishing LLC, 1012 Morton St, Baltimore, MD 21201. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. While we believe the sources of information to be reliable, we in no way represent or guarantee the accuracy of the statements made herein. Energy and Capital does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Neither the publisher nor the editors are registered investment advisors. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law. Please note: It is not our intention to send email to anyone who doesn't want it. If you're not sure why you're getting this e-letter, or no longer wish to receive it, get more info here, including our privacy policy and information on how to manage your subscription. | |

This site is an experiment in sharing news and content. Almost everything here came from email newsletters.

Sponsor

2011/12/02

Wanted: Vanadium Supply

@

10:09

Subscribe to:

Post Comments (Atom)

Label Cloud

Technology

(1464)

News

(793)

Military

(646)

Microsoft

(542)

Business

(487)

Software

(394)

Developer

(382)

Music

(360)

Books

(357)

Audio

(316)

Government

(308)

Security

(300)

Love

(262)

Apple

(242)

Storage

(236)

Dungeons and Dragons

(228)

Funny

(209)

Google

(194)

Cooking

(187)

Yahoo

(186)

Mobile

(179)

Adobe

(177)

Wishlist

(159)

AMD

(155)

Education

(151)

Drugs

(145)

Astrology

(139)

Local

(137)

Art

(134)

Investing

(127)

Shopping

(124)

Hardware

(120)

Movies

(119)

Sports

(109)

Neatorama

(94)

Blogger

(93)

Christian

(67)

Mozilla

(61)

Dictionary

(59)

Science

(59)

Entertainment

(50)

Jewelry

(50)

Pharmacy

(50)

Weather

(48)

Video Games

(44)

Television

(36)

VoIP

(25)

meta

(23)

Holidays

(14)

Popular Posts (Last 7 Days)

-

For your weekly reading, we bring you the week's most popular stories from Wealth Daily and our sister site, Energy and Capital… ͏ ͏ ͏...

-

Is yours on the list? Plus: Betterment hacked, AI reality scam, SpaceX's flaming debris near-miss and more ...

No comments:

Post a Comment

Keep a civil tongue.