| |

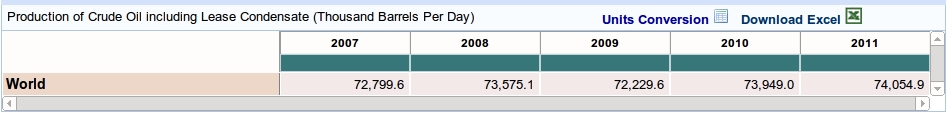

| Don't Worry, There's Plenty of Oil By Nick Hodge | Saturday, July 21st, 2012 Get ready to be confused... and maybe even question your entire reality. We already know LIBOR was being manipulated. That's the rate every single interest rate in the world is derived from: municipal bonds, money markets, your credit card — everything. And it was all smoke and mirrors. The rates being set at whatever level was needed for fat-cat bankers to make even more money. We also learned HSBC (NYSE: HBC), a $165 billion bank, voluntarily laundered billions for terrorists and drug cartels. So basically, in the past few weeks we've learned what most suspected: Wall Street is a Machiavellian Wild West where only those in charge know what's happening. Advertisement The Vanadium Alone Could Make You 2,900% Richer... That's just one of eight metals this tiny explorer controls. Then there's the lithium, exceeding its market cap by 310xs... enough to turn every $1,000 into $31,000. All told, the total value of all of this explorer's metals exceeds its market cap by over 74,379%. But here's the real shocker: These figures come from just one of six mining parcels! It could be the most mind-blowing metals discovery ever... learn more here. These stories are getting no Main Street traction. And that's a shame, because they gnaw at the root of many of today's problems for the middle class. But I digress... I also have energy shenanigans to tell you about. The U.S. Energy Information Administration (EIA) is out with oil demand forecasts for the rest of this year and next. In its view, the world will need 88.64 million barrels of oil per day (BPD) for the rest of this year. Next year we'll need 89.37 million bpd. The International Energy Agency (IEA) was also out with its 2013 oil demand forecast. It says we'll need 90.9 million barrels per day next year. So the IEA is a bit more bullish, but the numbers are pretty close. But here's the thing: The world doesn't produce that much oil. It never has. Look at this info taken right from the EIA's website. It shows total world crude oil production for the last four years (click to enlarge):

That's about 16 million barrels per day shy of what we'll need next year. We've been making up the difference with natural gas plant liquids (NGPLs) and other liquids. Look what happens when we include them in total world production: Advertisement Don't Let This Moment Pass You By... Become a Wealth Wire Pro Member — entitling you to over $20,000 worth of the finest investment research on the Web for just $5/month! No hidden fees, no contracts, no joke. Click here for details before this offer expires! Still, the most “oil” (that word is in quotes because it's not oil — it's total liquid fuel — and calling it oil is a lie and a cover-up) the world has ever produced is 84.7 million barrels per day. And even that's over five million barrels per day short of what we'll need next year. Saying there's plenty of oil is like saying the integrity of LIBOR is fine. In the coming years, we'll need every BTU of oil, coal, natural gas, nuclear, solar, and wind that we can find. As I've said before, it isn't either/or; it's and/when. That's reality. Start living in it. Call it like you see it,

Nick Hodge The Future of Fracking: This Company's Technology Promises to Change the Frack Game Forever Three Natural Gas Stocks: 2012 Natural Gas Investments Election Year Investing: Should You Trust the Government? A Perfect Storm for Biotech in 2012?: These Stocks Are Up 40% for the Year Saudis' Secret Oil Dilemma: Crisis Strikes Riyadh Platinum Cheaper than Gold: The White Metal Reaches a Tipping Point Solar Bottom: Second Half Could Shine Global Deflation: Prepare for More Printing with Gold American Energy Investing: OPEC Is Done! Silver and Gold, Silver and Gold: What Does Velocity Have to Do With It? Record Growth in Solar: Prices Falling, Stocks to Rise The Bottom Line | |

| This email was sent to ignoble.experiment@arconati.us . You can manage your subscription and get our privacy policy here. Energy and Capital, Copyright © 2012, Angel Publishing LLC, 1012 Morton St, Baltimore, MD 21201. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. While we believe the sources of information to be reliable, we in no way represent or guarantee the accuracy of the statements made herein. Energy and Capital does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Neither the publisher nor the editors are registered investment advisors. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law. Please note: It is not our intention to send email to anyone who doesn't want it. If you're not sure why you're getting this e-letter, or no longer wish to receive it, get more info here, including our privacy policy and information on how to manage your subscription. | |

This site is an experiment in sharing news and content. Almost everything here came from email newsletters.

Sponsor

2012/07/21

Don't Worry, There's Plenty of Oil

@

08:04

Subscribe to:

Post Comments (Atom)

Label Cloud

Technology

(1464)

News

(793)

Military

(646)

Microsoft

(542)

Business

(487)

Software

(394)

Developer

(382)

Music

(360)

Books

(357)

Audio

(316)

Government

(308)

Security

(300)

Love

(262)

Apple

(242)

Storage

(236)

Dungeons and Dragons

(228)

Funny

(209)

Google

(194)

Cooking

(187)

Yahoo

(186)

Mobile

(179)

Adobe

(177)

Wishlist

(159)

AMD

(155)

Education

(151)

Drugs

(145)

Astrology

(139)

Local

(137)

Art

(134)

Investing

(127)

Shopping

(124)

Hardware

(120)

Movies

(119)

Sports

(109)

Neatorama

(94)

Blogger

(93)

Christian

(67)

Mozilla

(61)

Dictionary

(59)

Science

(59)

Entertainment

(50)

Jewelry

(50)

Pharmacy

(50)

Weather

(48)

Video Games

(44)

Television

(36)

VoIP

(25)

meta

(23)

Holidays

(14)

Popular Posts

-

Plus: PayPal's sneaky move, new AI coming, best time to post on Facebook ...

No comments:

Post a Comment

Keep a civil tongue.