| |

| The Must-Own Natural Gas Stock for 2013 By Keith Kohl | Friday, January 11th, 2013 Taking a bullish stance on natural gas isn't easy. Not by any means. Ever since 2008 — when we saw energy prices get decimated within just a few short months, turning investors bearish practically overnight — nobody seems willing to look down the road. And who could blame their pessimism after witnessing this...

Today the natural gas industry has become a place where bearish investors are suddenly turning bullish. Go ahead and look, the numbers won't lie to you... Advertisement 3 Fracking Superstars There are a few truths to the fracking superboom going on in the United States:

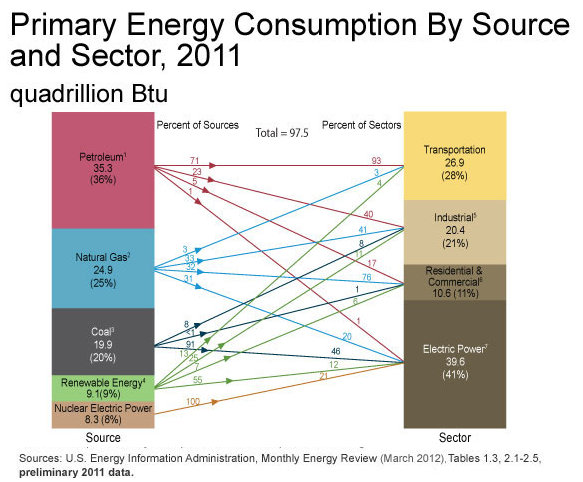

Get all the details here — before it's too late. Where Bullish Bears Roam Before I go on, it's important to note this bullish outlook for natural gas isn't a side-effect of raging speculation over future U.S. LNG exports. I'll touch on some of my reservations toward that debacle later next week, but for the moment, we'll stick to our home turf — which is where we'll be directing our natural gas supply. Production may be at record levels, but so is demand. We're using nearly 70 billion cubic feet of natural gas every day. And slowly but surely, it's beginning to displace coal in the industrial sector. You see, coal simply isn't able to stay competitive in this low-price environment (and coal will still remain our biggest source of electrical generation for years to come). As you can see below, natural gas is evenly divided among three sectors.

It's enough to get even the most stubborn of bears on board. Two Win-Win Natural Gas Investments in 2013 Ever wonder what will make a bear turn bullish over natural gas? A simple guaranteed winner. It's that easy. I'm talking about a company that allows individual investors like us to pocket cold, hard cash, no matter what happens to the price of natural gas. Sound impossible? That's an understandable concern, given the current gas glut... But take a second to look at that natural gas price chart again. I know it isn't a pretty sight — and the oversupply we'll have over the next few years eliminates all hope for a price spike — but it's also created an overabundance of bearish sentiment in the market. Last year I called Linn Energy the only sure bet in natural gas; so far it's been able to flourish as natural gas prices collapsed 76% from 2008 highs. There's no question that this has become one of the few must-own natural gas stocks for 2013:

But I want to point out that this pick's appeal is not solely the fact that shares have jumped almost fourfold during a period when natural gas prices crashed, falling below $2.00/Mcf last April... No. The most attractive part, dear reader, is the nearly 8% yield the play comes with — a dividend that has been steadily rising despite all the volatility to hit the market throughout the recession. And it turns out I'm not the only bull in the room when it comes to the long-term profitability of natural gas. “It's a win-win scenario for me, even if prices never climb higher. Its actually better for these stocks if we don't see a price increase ever again,” my colleague Christian DeHaemer told me when he stopped by my desk this morning — as if he were hoping for another crash. That's the trick to finding upcoming natural gas profits... Forget the low prices and even the oversupply; having a cheap, abundant source of energy at our disposal will be the catalyst for a radical switch in the way we view our future energy security. Before he walked away from my desk, Christian explained his strategy on taking advantage of the fundamental energy shift taking place in a specific sector, one that oil has dominated for over a century... It all hinges on a crucial piece of infrastructure that must first be put into place. Until next time,

Keith Kohl A true insider in the energy markets, Keith is one of few financial reporters to have visited the Alberta oil sands. His research has helped thousands of investors capitalize from the rapidly changing face of energy. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital as well as Investment Director of Angel Publishing's Energy Investor. For years, Keith has been providing in-depth coverage of the Bakken, the Haynesville Shale, and the Marcellus natural gas formations — all ahead of the mainstream media. For more on Keith, go to his editor's page.

The Best Bakken Oil Stocks Under $10 More than 6 billion barrels of light, sweet crude oil sit in North Dakota's Bakken oil pool. But the best Bakken stocks to own are still less than $10 a share. You could make 153% or more — but you'll need to act fast... Your Special Report, "Bakken Billions: 3 Bakken Stocks Under $10 for Triple Digit Gains," is waiting. Click here to get your FREE copy of this groundbreaking investment report. The Bottom Line Related Articles A Brief History of FrackingThe Boom and Bust of U.S. Oil Investing Warren Buffett Bakken Shale Investment Marcellus Gas Production Recently... Before Matt Damon, There was Colonel Edward RobertsEveryone's a Henry Ford Oil Crisis Brewing in Alaska Buy This Bakken Shale Play Now! Energy and Capital's Weekend Edition | |

| This email was sent to ignoble.experiment@arconati.us . You can manage your subscription and get our privacy policy here. Energy and Capital, Copyright © 2013, Angel Publishing LLC, 1012 Morton St, Baltimore, MD 21201. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. While we believe the sources of information to be reliable, we in no way represent or guarantee the accuracy of the statements made herein. Energy and Capital does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Neither the publisher nor the editors are registered investment advisors. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law. Please note: It is not our intention to send email to anyone who doesn't want it. If you're not sure why you're getting this e-letter, or no longer wish to receive it, get more info here, including our privacy policy and information on how to manage your subscription. | |

This site is an experiment in sharing news and content. Almost everything here came from email newsletters.

Sponsor

2013/01/11

The Must-Own Natural Gas Stock for 2013

@

12:07

Subscribe to:

Post Comments (Atom)

Label Cloud

Technology

(1464)

News

(793)

Military

(646)

Microsoft

(542)

Business

(487)

Software

(394)

Developer

(382)

Music

(360)

Books

(357)

Audio

(316)

Government

(308)

Security

(300)

Love

(262)

Apple

(242)

Storage

(236)

Dungeons and Dragons

(228)

Funny

(209)

Google

(194)

Cooking

(187)

Yahoo

(186)

Mobile

(179)

Adobe

(177)

Wishlist

(159)

AMD

(155)

Education

(151)

Drugs

(145)

Astrology

(139)

Local

(137)

Art

(134)

Investing

(127)

Shopping

(124)

Hardware

(120)

Movies

(119)

Sports

(109)

Neatorama

(94)

Blogger

(93)

Christian

(67)

Mozilla

(61)

Dictionary

(59)

Science

(59)

Entertainment

(50)

Jewelry

(50)

Pharmacy

(50)

Weather

(48)

Video Games

(44)

Television

(36)

VoIP

(25)

meta

(23)

Holidays

(14)

That's bound to happen when our domestic production is consistently hitting new records. Our total gas output this year is on track to top more than 29 trillion cubic feet (remember, that includes the steep decline in the number of rigs drilling for natural gas, which was nearly cut in half during 2012).

That's bound to happen when our domestic production is consistently hitting new records. Our total gas output this year is on track to top more than 29 trillion cubic feet (remember, that includes the steep decline in the number of rigs drilling for natural gas, which was nearly cut in half during 2012).

@KeithKohl1 on Twitter

@KeithKohl1 on Twitter

No comments:

Post a Comment

Keep a civil tongue.