|

This site is an experiment in sharing news and content. Almost everything here came from email newsletters.

Sponsor

2021/02/19

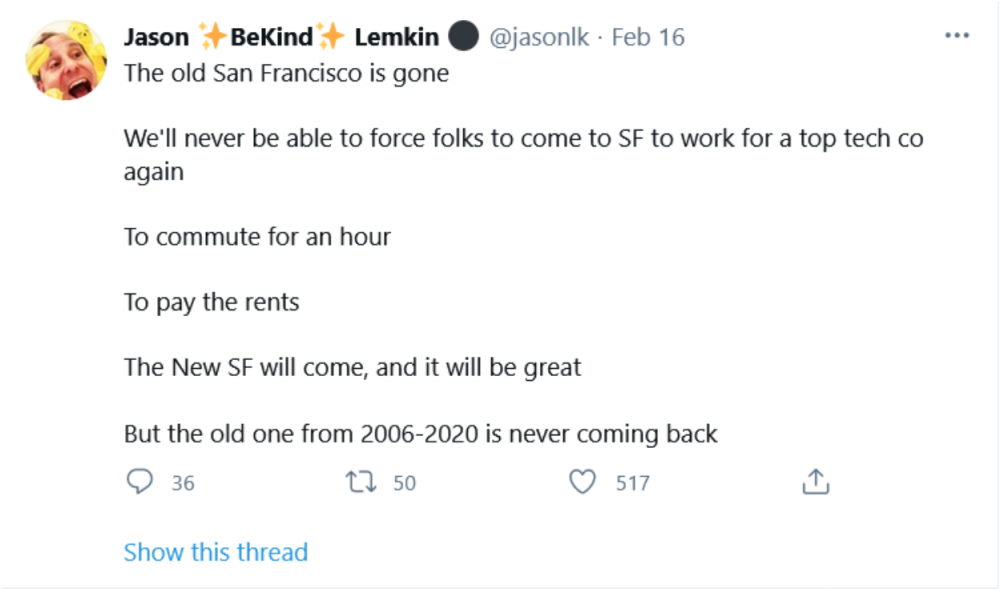

Silicon Valley Is Losing Dominance

@

10:47

Subscribe to:

Post Comments (Atom)

Label Cloud

Technology

(1464)

News

(793)

Military

(646)

Microsoft

(542)

Business

(487)

Software

(394)

Developer

(382)

Music

(360)

Books

(357)

Audio

(316)

Government

(308)

Security

(300)

Love

(262)

Apple

(242)

Storage

(236)

Dungeons and Dragons

(228)

Funny

(209)

Google

(194)

Cooking

(187)

Yahoo

(186)

Mobile

(179)

Adobe

(177)

Wishlist

(159)

AMD

(155)

Education

(151)

Drugs

(145)

Astrology

(139)

Local

(137)

Art

(134)

Investing

(127)

Shopping

(124)

Hardware

(120)

Movies

(119)

Sports

(109)

Neatorama

(94)

Blogger

(93)

Christian

(67)

Mozilla

(61)

Dictionary

(59)

Science

(59)

Entertainment

(50)

Jewelry

(50)

Pharmacy

(50)

Weather

(48)

Video Games

(44)

Television

(36)

VoIP

(25)

meta

(23)

Holidays

(14)

Popular Posts (Last 7 Days)

-

The product you were looking at is running low on stock ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏...

-

This is it. Sale ending tonight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

-

4 Gifts for the price of 2 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

No comments:

Post a Comment

Keep a civil tongue.