You know some of the most fateful words in finance are, "It'll be different this time."

And I'm hearing them a lot these days about the economy.

There are a lot of similarities to the start of the 1970s…

And in case you didn't know, that was a period of high inflation and low growth, or stagflation.

But I'm hearing a lot of analysts out there claiming that it's different this time.

But.. The Peak

And one of the strongest arguments they make is that inflation didn't peak back then until it was well above 14% in 1980.

They're saying that's a lot higher than the peak this time of around 9%.

But in order to make that argument, they're assuming that we've already seen the peak of inflation.

They're assuming that because energy prices have fallen, inflation must be falling too.

But energy prices are notoriously volatile. And they're being manipulated into falling right now.

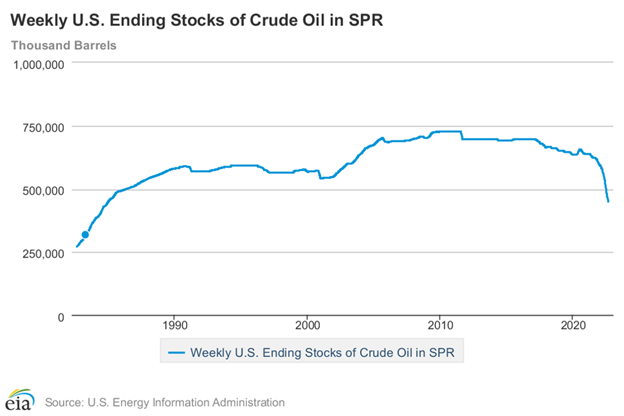

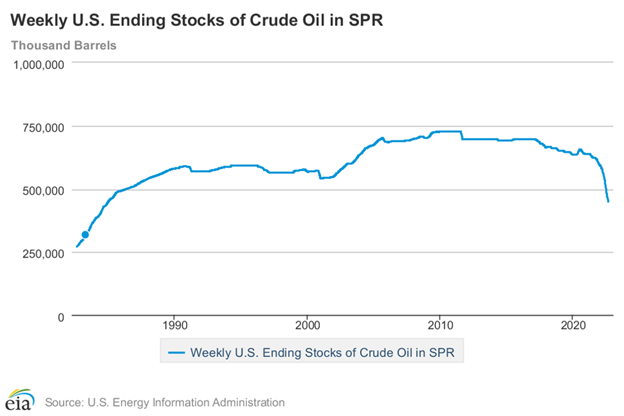

Every day since March of this year, the U.S. has been releasing 1 MILLION barrels of oil from our strategic reserves into the open market.

To put that into perspective, that's about one-third of the daily production of the oil-rich United Arab Emirates.

It's a lot of oil. And it's had the desired effect of making gas cheaper at the pump for millions of Americans.

But it's got to stop eventually. It was only scheduled to run until the end of this month.

And while it was extended to run until mid-October (and might be extended to run through mid-term elections in November), it can only be extended so far.

And that's because there's a limited amount of oil in the reserve. It's not endless.

It'll need to be refilled pretty soon because currently, it's at its lowest level since 1984.

The U.S. government buying hundreds of millions of barrels on the open market is going to have one effect and one effect only: It will drive prices up.

So we can pretty much bet that we haven't seen the peak in energy costs here in the U.S.

And we can be 100% sure it'll get more expensive in Europe as winter rolls in and that Russian gas does not.

So there's one argument for why it'll be different this time out the window.

Biden's Spending "Blitz" Set to Launch $5 EV Firm

Over $9 billion in federal cash is set to rain down on one overlooked sector of the EV market...

And this flood of government capital could send one $5 stock soaring in short order.

This could be the biggest EV story of our lifetime.

Learn about the shocking EV company nobody's talking about.

But… The Fed

Then they tell me that the Federal Reserve has shown that it'll "do what it takes" to rein in inflation.

But will it really? I mean, seriously…

These people all have their eyes on cushy jobs working for the Treasury Department (like Janet Yellen) or for political think tanks (like her predecessor, Ben Bernanke) or consulting for investment banks (like their predecessor, Alan Greenspan).

And they don't want to kill their future job prospects by making life difficult for those bankers, politicians, or political donors.

So while they sound pretty serious and hawkish right now, I'm not sure I believe they'll stick to their guns when the stock market's down a full 40% or 50% from the peak.

I'm pretty sure they'll go neutral then. And after a relief rally in the markets that ends in more pain, they'll start lowering rates and easing financial conditions again.

Got to keep the future boss happy.

But even if they had the gall to stick to the plan and do what's necessary to kill inflation, they couldn't afford it.

You see, the Federal Reserve is a bank. It's the bank of bankers. And big banks like Citigroup, Bank of America, Wells Fargo, and their ilk keep money on deposit with the Federal Reserve.

They do it because they have to. It's a law that came into effect after the 2008 banking crisis.

Now they've got to keep reserves on deposit at the Fed to make sure they can cover enough losses in the event that something like 2008 happens again.

And as with any bank account, they get paid interest on their deposits.

Up until this year, that rate was about 0.15%. Not too much.

But now it's up above 2.5%. And that adds up to hundreds of billions of dollars in interest due to be paid by the Fed.

Boost the fed funds rate and that interest rate goes up too.

Boost that interest too rate much and the Fed doesn't have enough money to pay interest on those deposits.

They literally can't afford to raise interest rates high enough to kill inflation.

So they'll do their best but likely fail.

They'll either lose their courage in the face of mounting losses and growing political pressure...

Or they'll realize that they are having a hard time paying the bills and act to make their bills lower.

Unfortunately, that action will add fuel to the fire that's driving our bills higher.

So there's another "it's different this time" argument we can leave by the wayside.

Mark Your Calendar: November 15, 2022, Could Make You Very Rich

When this little-known tech company makes its announcement on November 15, 2022... it will send shock waves throughout the world. Google's CEO, Sundar Pichai, says it's humanity's most important invention.

And the few people who know about it ahead of time could make millions.

Because this company's new breakthrough — Invictus — is about to blow the doors off a $47 TRILLION revolution, transforming practically every aspect of society.

Let me show you how to get in before November 15, 2022.

But… The Government

I've saved the dumbest argument for last, as you can see…

Because I also hear that the government is going to step in with price controls and punitive taxes on corporate profits…

And that it's going to spend our way out of high inflation and slow growth.

Now, if we were just battling slow growth, I might be on board. Government spending can stimulate growth.

But when it's too much government spending that's fanning the flames of inflation, I have a hard time believing that more government spending is going to put out the fire.

Thinking that more spending will solve the problem that overspending caused is just plain stupid.

And I know you're not that dumb, because you're reading Wealth Daily and not watching MSNBC.

So I'm not even going to waste your time explaining that one.

But let's talk about price controls and punitive taxes…

Because they don't work either.

Never in the history of taxation has a corporation not passed on new taxes to its customers.

Literally every time a corporation's costs increase, so do the prices we pay for its goods and services.

Period. Hard stop. Sure, it's not right. But it is what it is, and that's how it works.

Sales tax isn't a tax on the buyer. It's a tax on the seller, the one making the SALE.

But who pays it? You and I do, because companies can pass it on in the price of their items.

So don't hold your breath for punitive profit taxes to put a lid on price increases. They're more likely to make your prices go up than down.

Then we come to price caps. That's literally when the government tells a company how much it can charge.

It's the opposite of a free market. And while price caps do tend to hold prices down while in effect, as soon as they're gone, prices tend to shoot up past where they'd have gotten on just inflationary pressures alone.

Nixon tried it back in the 1970s (so I guess the situation now is not that different if we're hearing talk of them again).

But they failed miserably.

In 1971, Nixon imposed a 90-day freeze on wages and prices in order to counter inflation (which was then running at what seems today like a low 5.84%).

It was part of a policy shift that earned the moniker the "Nixon shock."

And its effect was to cause the recession of 1973–75 and lead to the stagflation of the 1970s.

Are You Sick of Market Crashes Gutting Your Retirement Account?

There's a way to flip the market carnage into a legal fortune…

Without shorting a single stock…

And without touching options, cryptos, or "meme" stocks.

This radical "blueprint'' could help anyone turn $500 into $1.2 million in under a year.

For more details, go here now.

Yet here we are again with our esteemed leaders tossing the same ideas around.

Doesn't sound very different to me.

So what's an investor to do?

Invest Like It's 1969

Well, one thing we can do is take a look back at the investments that succeeded during the 1970s…

Real estate wasn't a bad one. The Nareit index was up 100% between 1971 and 1981.

Energy and commodities were good too…

The S&P GSCI commodity index rose 586% from 1970–79. But gold was the standout winner, as it rose from around $270 in 1970 to over $2,500 by 1980.

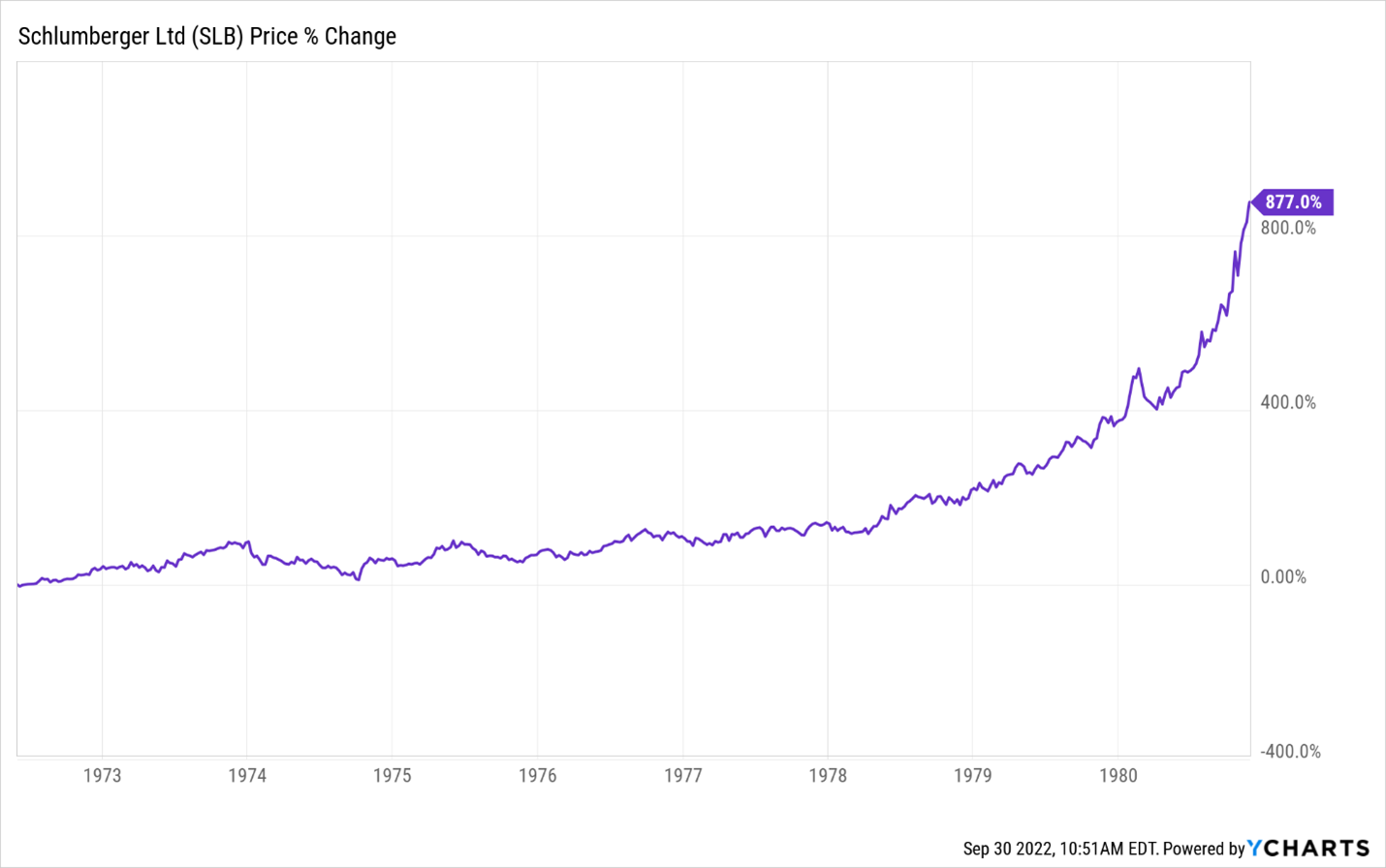

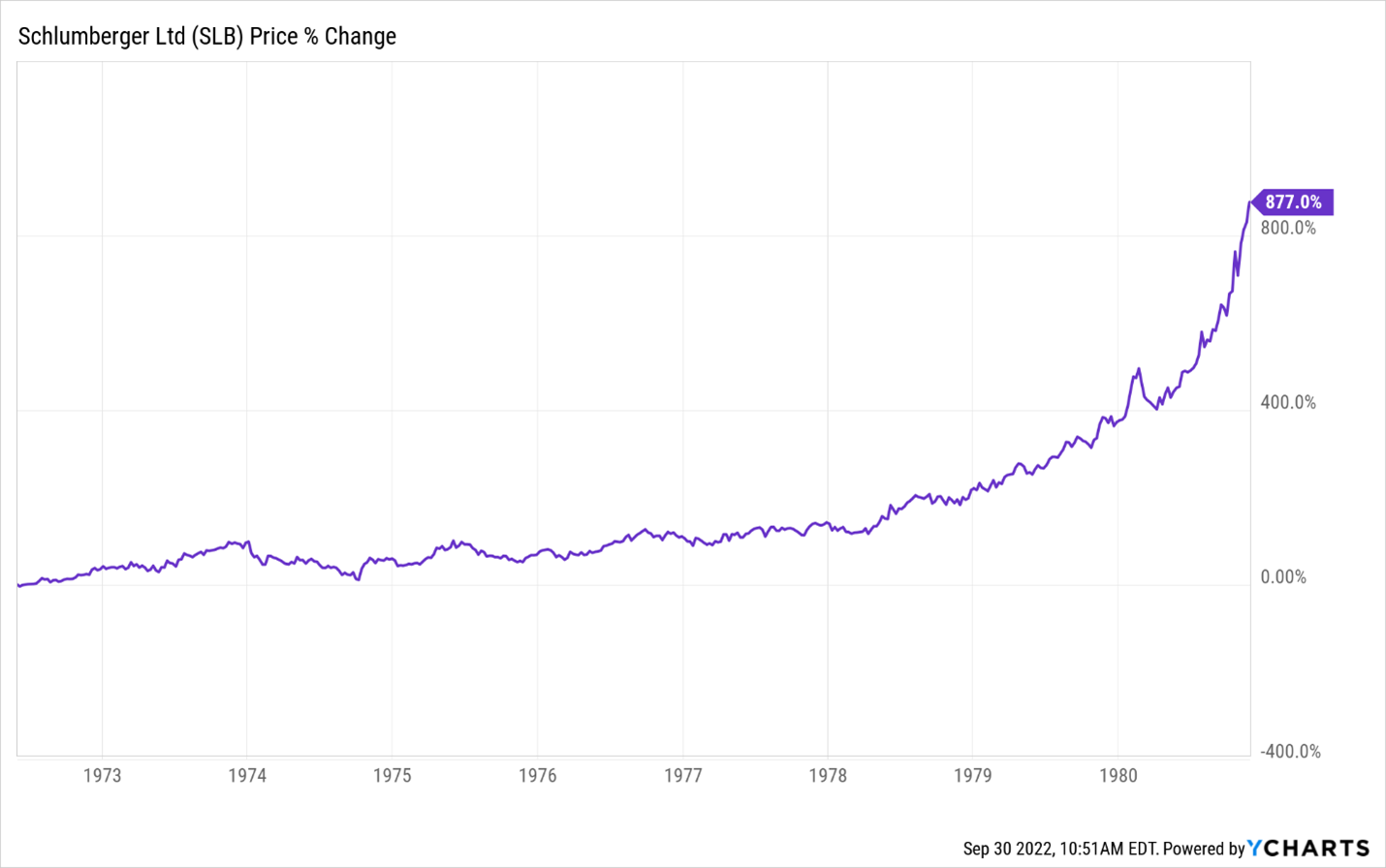

Energy-related investments like Slumberger (SLB) returned even better, clocking in at nearly 900%:

So there are reasons to expect that we'll see something similar to what we saw in the 1970s.

But there are also ways to beat stagflation.

These are just a few of them...

But if you keep reading the commentary from me and my fellow authors here at Wealth Daily and our parent company, Angel Publishing, you'll have access to all the best ways to beat the market and protect your portfolio from whatever comes our way.

So make sure you're keeping an eye out for our next article. It's sure to be a good one.

To your wealth,

Jason Williams

@TheReal_JayDubs

@TheReal_JayDubs

Angel Research on Youtube

Angel Research on Youtube

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; the editor of Alpha Profit Machine, an algorithmic trading service designed specifically for retail investors; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube

No comments:

Post a Comment

Keep a civil tongue.