| Customers who put their cash and cryptocurrency into Gemini Earn thought it was secure, akin to a savings account at a bank, Emily writes. - "It sounded really safe," Peter Chen, a data scientist in San Diego, who started putting money in Earn in late 2021, told Axios.

Why it matters: Chen said he was especially reassured when Gemini customer service sent him an email and mentioned FDIC insurance — the protection that keeps bank deposits safe in the U.S. But his money, since converted to cryptocurrency, wasn't safe. - Chen put $17,995 into Earn, according to statements he shared — and he can't get it out. He is one of 340,000 customers who have $900 million locked up at Earn, according to the Securities and Exchange Commission.

How it worked: Launched by the famed twins Cameron and Tyler Winklevoss, Earn promised to pay interest rates of as much as 8% to depositors. - "Lovin' the 8.05%," Chen messaged Axios back in February 2022 via Twitter.

- He used dollars to buy Gemini's stablecoins, called GUSD; the company paid interest on those holdings.

What happened: In June, Chen watched the collapse of another stablecoin — called luna — and got nervous. He sent an email to Gemini customer service, viewed by Axios, and asked: "Will something like this happen to GUSD? Is my money safe?" - A representative responded: "All fiat currency held by Gemini to redeem your GUSD is held by our partner financial institutions in a secure account and is eligible for FDIC insurance."

- On Nov. 16, in the wake of the collapse of FTX, Earn froze withdrawals.

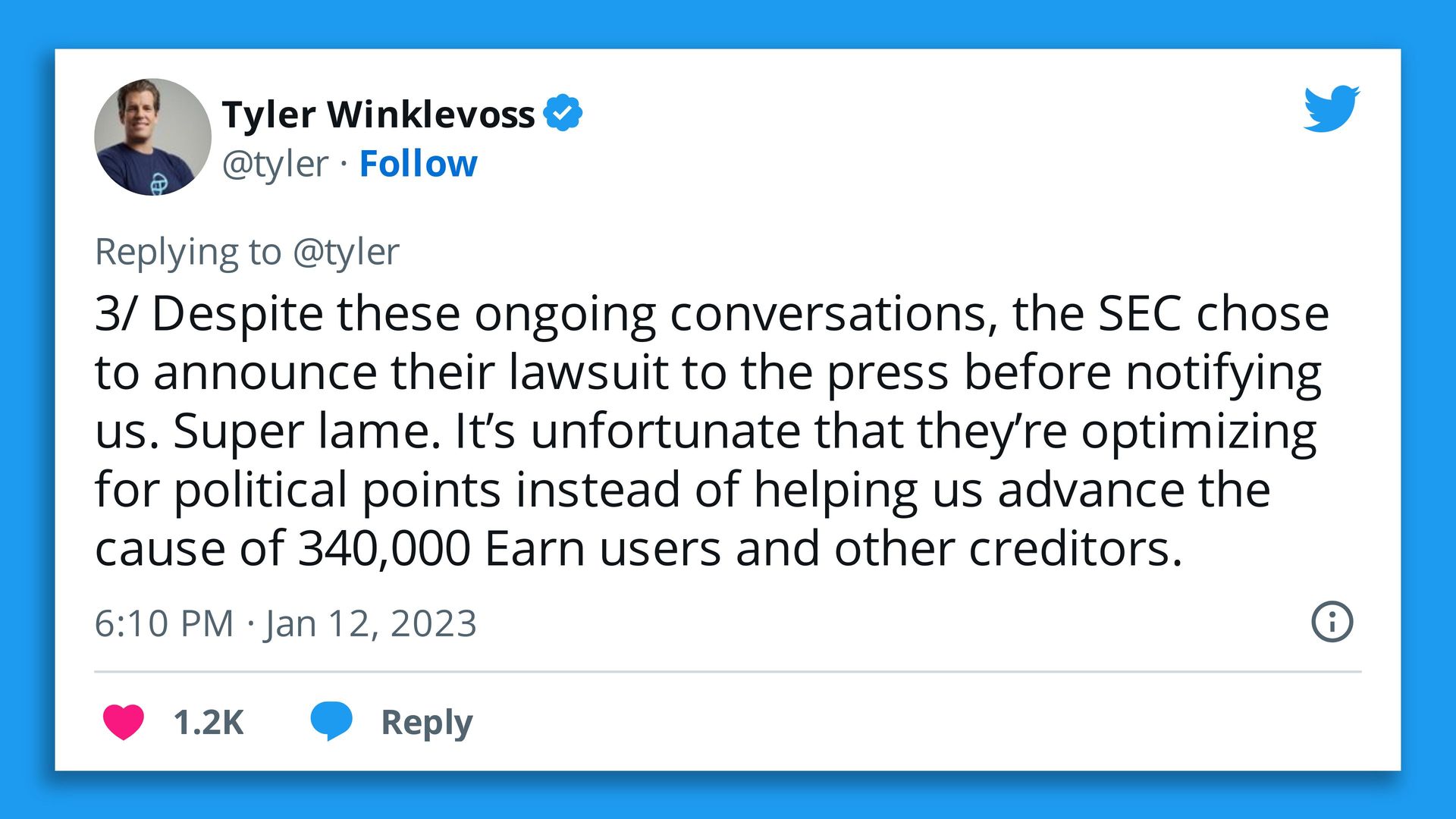

Worth noting: The FDIC in August warned five companies about making misleading statements about deposit insurance — that's the protection that keeps your money safe in the bank — though Gemini wasn't included. Driving the news: Last week, the SEC filed a complaint against Gemini and its partner, Digital Currency Group's Genesis Global Capital, claiming that Earn violated the law by offering unregistered securities. For the record: The company declined to comment to Axios. But in response to a lawsuit filed by Earn customers, Gemini argues that they knew about the risks. - "In enrolling in the Gemini Earn program, Plaintiffs acknowledged that their assets were leaving Gemini's custody and that they faced the risk of "'TOTAL LOSS,'" the filing says. (Chen said he wasn't aware. "They gave me the vague impression that it was FDIC-insured.")

- More publicly, Gemini has blamed its partner Genesis for the situation.

Zoom out: There's a perception that crypto investors were wild, risk-taking, Lambo owners — or aspiring owners. Types who understood the wild ride they were on. - But many who put their money into Earn were of a different mindset. Not angling to become the next crypto millionaire — rather, just trying to earn high-single digits on savings.

What they're saying: "You are seeing normal 'middle-class' folks, putting in life savings. Sometimes this is it. All of it," said Hee-Jean Kim, a lawyer at Kim & Serritella LLP, which filed a class action against Gemini at the end of December. Go deeper |

No comments:

Post a Comment

Keep a civil tongue.