May 30, 2024 | Read Online | | Value Investor Daily #30 3 Energy Companies With Upside |

| | | In partnership with |  |

| | Put your money to work in a high-yield cash account with up to $2M in FDIC† insurance through program banks. | Get started today, with as little as $10. | | The continued rapid expansion of artificial intelligence (AI) technology is significantly boosting the overall demand for energy and utilities. | AI's computational needs are leading to a surge in energy consumption, particularly from data centers that house AI servers, which are highly power-intensive. | As AI continues to grow, its impact on the energy sector becomes increasingly profound, driving substantial changes and creating new opportunities. The demand for energy to run these AI systems is growing at 26-36% per year. | In this piece, we discuss three undervalued companies in the energy and utilities sectors that present compelling buy opportunities.

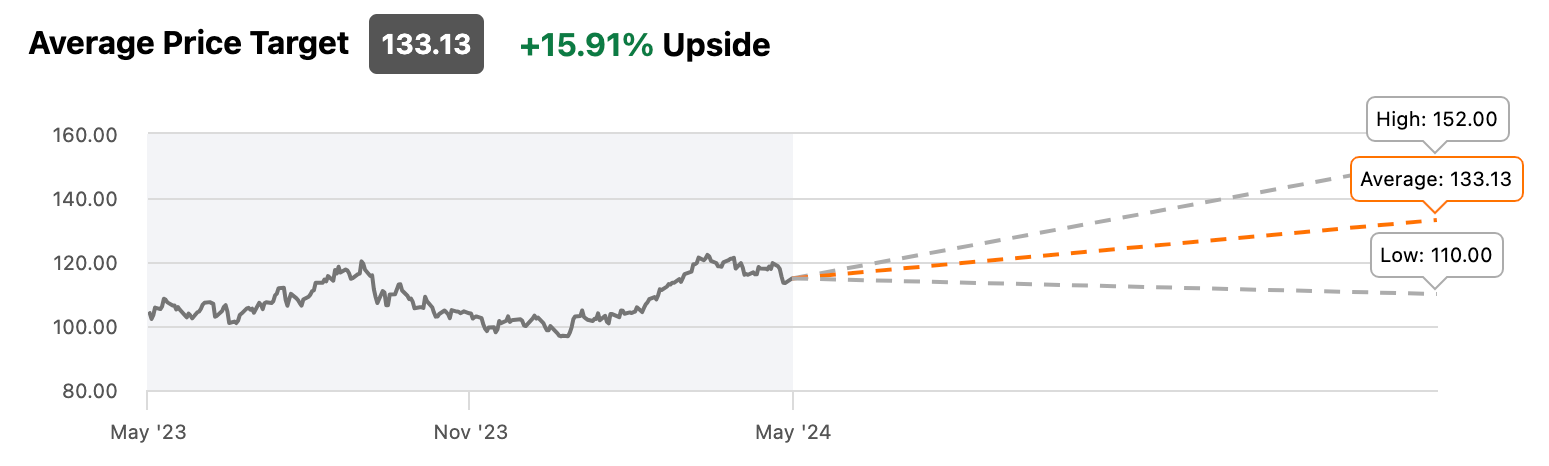

Exxon Mobil Corporation | Exxon Mobil (NYSE: XOM) is the leading entity in the Oil, Gas & Consumable Fuels industry, specializing in the exploration and production of crude oil and natural gas both domestically and internationally. | Year-to-date, Exxon Mobil's share price has increased nearly 14%, and we believe there is still room for further upside. | Fair Value Analysis: | Using 15 valuation methods, including DDM Stable Growth, Earnings Power Value, P/E Multiples, Price/Sales Multiples, and a 10-Year DCF Revenue Exit, the average fair value estimate is around $136, suggesting a 19.6% upside from the current stock price.

| Wall Street Analyst Targets: | |  | Source: Seeking Alpha |

| On May 3, Exxon Mobil announced the completion of its acquisition of Pioneer Natural Resources, creating an unconventional business with the largest high-return development potential in the Permian Basin. | Exxon Mobil has maintained dividend payments for 54 consecutive years and raised its dividend for 41 consecutive years, currently yielding 3.35%. | Recently, Morgan Stanley analysts resumed coverage of Exxon Mobil, emphasizing the company's robust growth potential and favorable valuation. | They highlighted Exxon's broad operations across energy, chemicals, and emerging low-carbon sectors, which provide a significant competitive edge and support sustainable growth and a distinctive value proposition. | According to analysts, Exxon Mobil's stock is trading at about a 55% discount to the broader market, nearly twice its historical discount. | This undervaluation persists despite Exxon offering a shareholder return yield of approximately 7% and achieving a cash flow growth rate that is double that of its peers in the energy sector. | These attributes make Exxon Mobil an attractive investment opportunity in the current market.

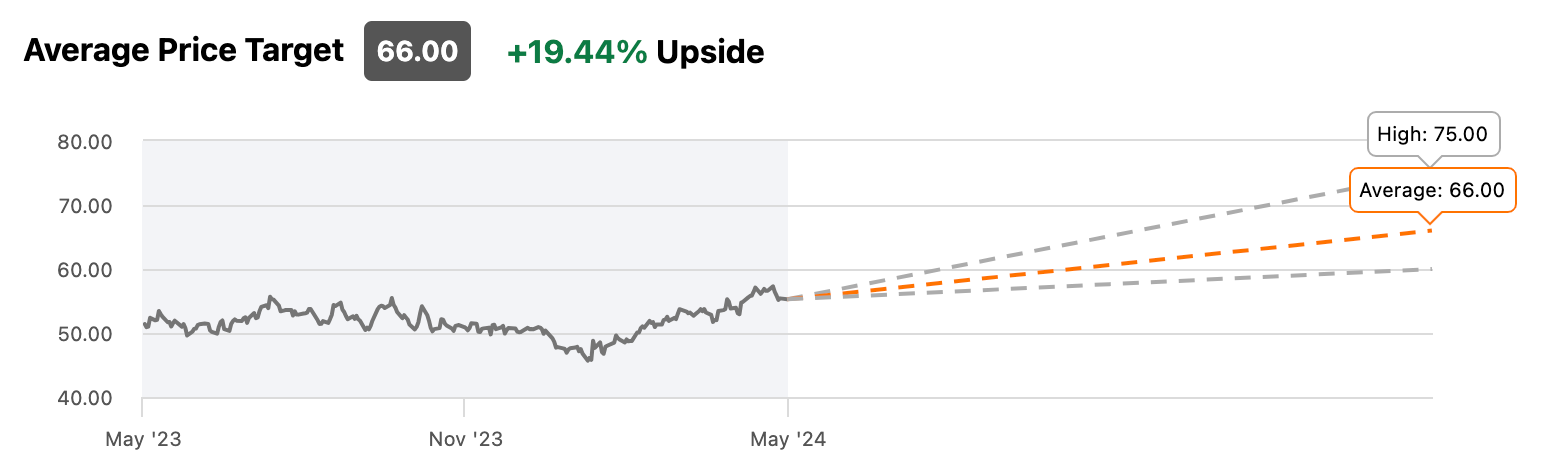

National Fuel Gas Company | National Fuel Gas (NYSE: NFG) operates as a diversified energy company through four segments: Exploration and Production, Pipeline and Storage, Gathering, and Utility. | Fair Value Analysis: | Using 13 valuation methods, including EV/Revenue Multiples, Earnings Power Value, P/E Multiples, Price/Book Multiples, and a 5-Year DCF EBITDA Exit, the average fair value estimate is around $64.50, implying a 16.7% upside from the current stock price.

| Wall Street Analyst Targets: | |  | Source: Seeking Alpha |

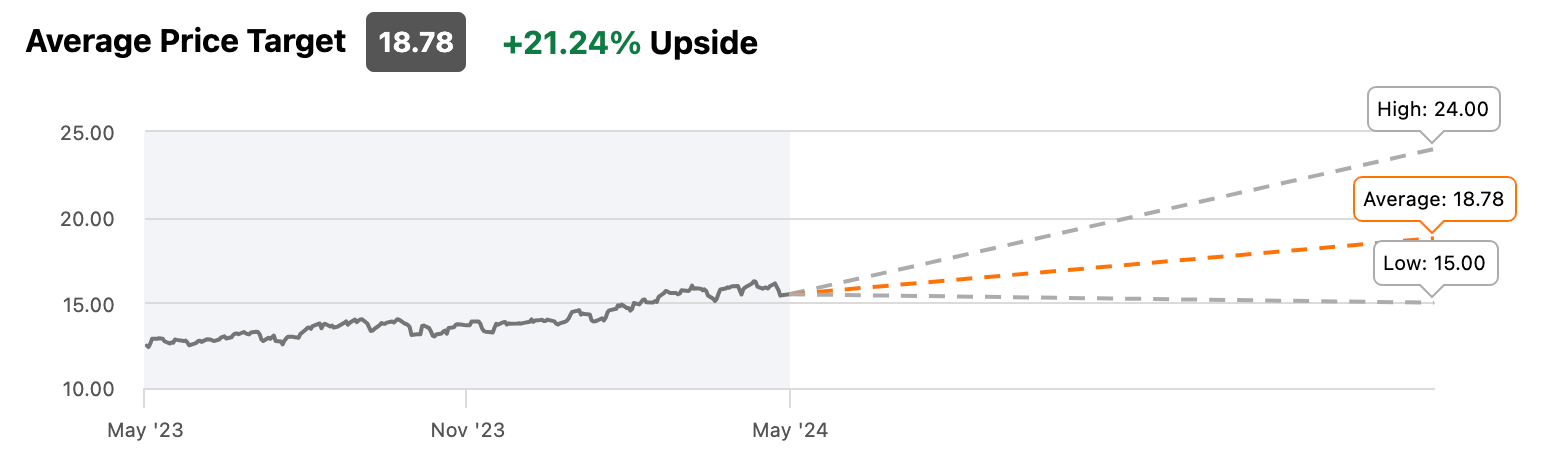

| Earlier this month, National Fuel Gas reported strong second-quarter performance, with adjusted EPS reaching $1.79 per share, a 16% increase from the previous year, exceeding Wall Street estimates. | The company's success was driven by its regulated businesses, which saw a 36% rise in earnings per share, along with a 10% increase in production from Seneca Resources and increased throughput in the gathering segment. | Despite some challenges, National Fuel remains committed to its strategy of hedging through price cycles and is optimistic about future natural gas prices. | The company has also announced a $200 million share buyback program (vs. $5B market cap) and ongoing investments in modernization and expansion projects. | National Fuel has maintained dividend payments for 54 consecutive years and raised its dividend for 53 consecutive years, currently yielding 3.57%. | Energy Transfer | Energy Transfer (NYSE: ET) owns and operates one of the largest and most diversified portfolios of energy assets in the United States, with more than 125,000 miles of pipeline and associated infrastructure. | Fair Value Analysis: | Using 14 valuation methods, including DDM Multi Stage, EV/Revenue Multiples, Earnings Power Value, P/E Multiples, EV/EBIT Multiples, and a 10-Year DCF Growth Exit, the average fair value estimate is around $19, implying a 22.6% upside from the current stock price.

| Wall Street Analyst Targets: | |  | Source: Seeking Alpha |

| On Wednesday, Energy Transfer and WTG Midstream announced that they have finalized a definitive agreement under which Energy Transfer will acquire WTG Midstream Holdings LLC. | The transaction is valued at approximately $3.25 billion. This acquisition will significantly expand Energy Transfer's network, adding over 6,000 miles of gas gathering pipelines and eight gas processing plants with a combined capacity of about 1.3 billion cubic feet per day (Bcf/d). | This strategic move enhances Energy Transfer's overall infrastructure and capabilities in the energy sector. | That's it for today. Thanks for reading! | | | Put your money to work in a high-yield cash account with up to $2M in FDIC† insurance through program banks. | Get started today, with as little as $10. | | Subscribe to our partners free: |     | | | |

| | | | | Copyright © 2024 Value Investor Daily, Kaizen Media, LLC. 11801 Domain Blvd 3rd floor, Austin, TX 78758. All rights reserved. No part of this newsletter may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law | Comprehensive Disclaimer: The content in this newsletter is strictly for educational and informational purposes. It is not, in any circumstance, intended as financial, investment, legal, or tax advice. The author and publisher of this newsletter are not licensed financial advisors, certified public accountants, or legal professionals. | While every effort has been made to provide accurate and up-to-date information, there is no guarantee that such information is free from errors, inaccuracies, or omissions. Investing, trading, or applying any of the strategies discussed herein carries inherent risks, and you should not rely solely on this information to make any financial decisions. | All forecasts, market viewpoints, calculations, and estimates published here are forward-looking statements and are therefore intrinsically unpredictable. Predictions are only forecasts constructed with educated assumptions and are not correlated whatsoever to future circumstances that may or may not happen in reality. Unforeseen events may impact returns or performance of securities discussed in this document. The information provided is current as of the preparation date and may not reflect future developments. Publisher is not obligated to update or revise this information. Readers should exercise judgment when making investment decisions based on this document. | Publisher and its associates may hold or acquire long or short positions in mentioned companies' securities, which may result in financial gain or loss. However, there is no guarantee that these positions will be maintained. | The publisher and its affiliates are not liable for any direct or consequential loss arising from the use of this information. The information provided is for informational purposes only and should not be considered a substitute for professional advice. The user is responsible for evaluating the accuracy, completeness, and usefulness of the information provided. The publisher and its affiliates do not endorse any products or services mentioned in this document. | This newsletter may contain links to third-party websites or resources. The author and publisher have no control over, and assume no responsibility for, the content, policies, or practices of any third-party websites. | To the fullest extent permitted by law, the author and publisher disclaim all liability for any loss, damage, risk, or consequence, whether direct, indirect, or consequential, faced by any person who directly or indirectly relies on the information provided in this newsletter. | You should consult with a qualified financial, legal, or tax professional before taking any action based on the content of this newsletter. | Affiliate & Sponsored Links Disclaimer: This newsletter may contain affiliate links or sponsored content. This means that if you click on one of these links and make a purchase or engage with the website, Publisher may receive a commission or benefit in some way. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them. | | | Update your email preferences or unsubscribe here © 2024 Value Investor Daily, Kaizen Media, LLC. 11801 Domain BIvd 3rd floor, Austin, TX 78758 228 Park Ave S, #29976, New York, New York 10003, United States | |

|

|

|

|

|

No comments:

Post a Comment

Keep a civil tongue.