This doesn’t happen often…

I’ve recently discovered a relatively unknown asset and have gone on record saying:

“The value of this company is absolutely compelling, and I have to learn more about it’s story… it’s basically a tier one asset when looking at the numbers, but is trading at an extreme discount”

In just the last year this company's market cap has increased by 35.40% as of December 2024...

And new drill results are due sometime before the end of this year or in early Q1 of 2025, which could push it even higher.

Their CEO has recently mentioned that they “aim to push through 5 million ounces of resource in the next year alone… With 3.66 million ounces of some of the highest-grade gold they’ve seen in their area already discovered”

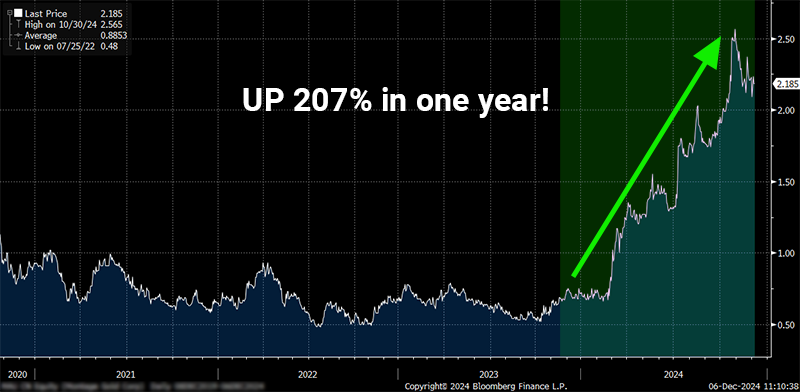

This primarily unknown asset is following in the footsteps of another company in the same region that has seen exceptional growth in the past year.

This other company had a market cap around 80M just last year and today is around 750M.

The stock has skyrocketed 207% YTD.

My readers had the opportunity to benefit from the better part of this gain as I recommended this stock in May 2024.

Giving my readers the chance at a 177.78% gain since May.

I believe this new company I’ve recently discovered will follow this same path.

It’s not just a hunch of mine…

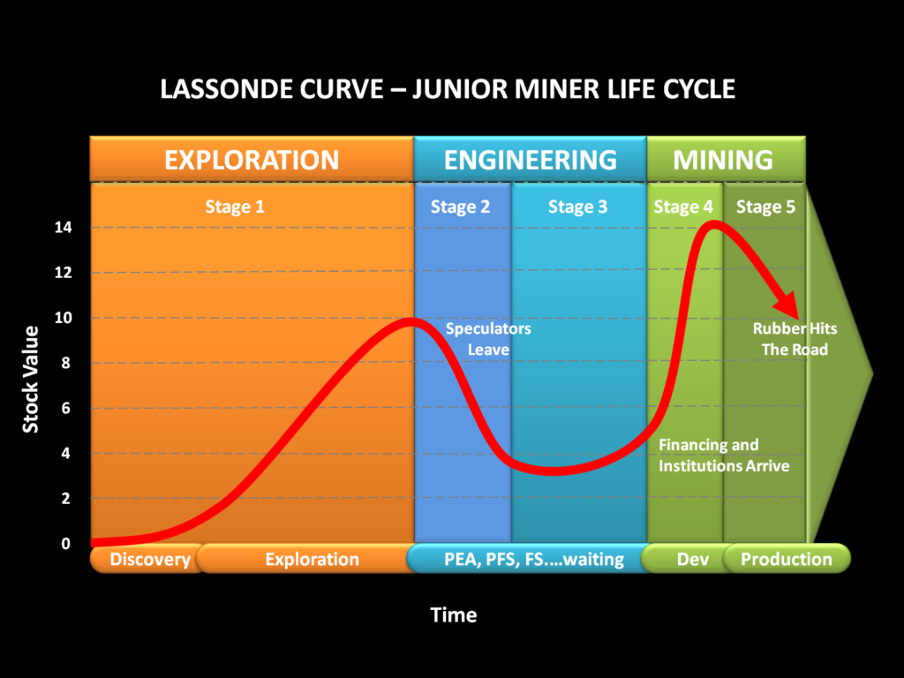

It’s a proven path small gold miners tend to follow.

Industry legend Pierre Lassonde famously discovered this path—called the Lassonde Curve—shown below.

Lassonde discovered a repeating pattern among the equities of gold miners.

Big money was made with exploration success.

Stage 1, when an explorer reports a wide width and high-grade initial discovery, the market awards them with a higher valuation overnight.

Then comes stage 2, speculators leave, and the stock value drops.

Stage 3, the hunt for financing pushes on. Financing can be complicated, and often causes the stock price to stagnate.

Stage 4, once financing is final, a great deal of uncertainty has been eliminated, and stock dilution is basically off the table.

The stock price can then begin to play catchup to total Net Asset Value.

I believe we are at the beginning of Stage 4 with this recently discovered gold miner, and I think we will see the stock price skyrocket in the coming year or two.

Click here to find out more about how you can get in on this junior miner before it takes off.

Best,

Garrett Goggin, CFA

Chief Analyst & Founder, Golden Portfolio

P.S. This company's CEO has recently said: "We're towards the bottom of the Lassonde Curve, but we shouldn't be right at the bottom of that curve, we believe we should be creeping up and much more aggressively."

Don't miss this chance to get in at the bottom, before it starts to climb.

No comments:

Post a Comment

Keep a civil tongue.