| TQ Evening Briefing | Markets pushed higher, but leadership narrowed… the kind of rally that asks who's buying, not how far it runs. | | | | | | This was a risk-on tape, but not a confident one. | Equities advanced into a holiday-shortened session with volatility compressing and liquidity thinning, yet participation stayed selective. | The bid favored familiar, liquid exposure… | primarily large-cap tech and energy… | while utilities and renewables absorbed policy-related pressure. | That divergence matters more than the index gains themselves. | Gold and silver breaking to new highs alongside rising equities tells you this isn't a chase. | Capital stayed invested, but it paid for protection. | Meanwhile, long-end yields firmed without disorder, reinforcing the idea that real-money positioning, not speculative leverage, is doing the heavy lifting. | This wasn't a market pricing acceleration. It was a market expressing preference. | Risk remains on, but it's conditional. | Leadership is narrow. | Conviction is measured. | And into year-end liquidity, that combination tends to persist longer than expected, until something forces a reassessment. |

| |

| | |

| | | | The Crypto That Survived the Crash—and Came Out Stronger | The recent crash wasn't just a selloff. It was a stress test. Weak projects cracked. Overleveraged traders got wiped out. Fear ruled the market. | But one crypto did the opposite. | While prices across the market collapsed, this coin's on-chain activity actually surged—more users, more transactions, more real demand. That kind of divergence doesn't happen by accident. It's a signal of strength the market hasn't fully priced in yet. | We've seen this setup before. And it led to gains of 8,600%, 3,500%, and 1,743%. | Now the selling pressure is fading—and the next leg higher could come fast. | See the crypto that passed the ultimate stress test (limited time). | © 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk. |

| |

| | |

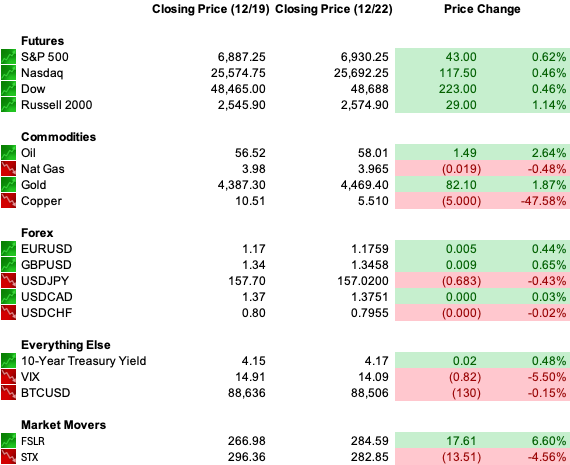

| | | | | WHAT'S ACTUALLY MOVING MARKETS |

| |

|

| | | Energy Strength Came From Enforcement | Crude's move was one of the few genuinely directional signals of the day. | Prices jumped on escalating enforcement pressure around Venezuelan oil flows, lifting the energy complex intraday. | This wasn't a demand story and it wasn't OPEC-driven. | It was a policy-and-mobility signal. | Markets repriced access risk rather than consumption, and energy responded accordingly. | Precious Metals Confirmed the Mood, Not the Fear | Gold and silver pushing to fresh records reinforced the tone of the session. | Equities rose, volatility fell, and yet protection outperformed. | That combination matters. | It suggests investors weren't reacting to stress, they were pre-positioning. | Rate expectations stayed intact, the dollar softened modestly, and capital chose to carry insurance rather than chase upside. | Deal Activity Added Texture | M&A headlines moved individual names — asset managers, media, select industrials — but they didn't alter market posture. | These were balance-sheet and confidence trades, not signals of a broader risk shift. | Macro data didn't drive price. | Earnings didn't reset expectations. | And despite holiday-thinned liquidity, there was no scramble for exposure. | The session wasn't about acceleration. | It was about confirmation… of leadership, of hedging behavior, and of where capital still feels comfortable showing up. |

| |

| | |

| | | | Investors Are Watching This Fast-Growing Tech Company | | No, it's not Nvidia… It's Mode Mobile, 2023's fastest-growing software company according to Deloitte. | Their disruptive tech has helped users earn and save $325M+, driving $75M+ in revenue and 50M+ consumer base. They've just been granted the stock ticker $MODE by the Nasdaq and over 56,000 investors participated in their previous rounds. | $60M+ already invested — claim your stake at $0.50/share and earn up to a 120% bonus. | Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur. The Deloitte rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period. The offering is only open to accredited investors. |

| |

| | |

| | | | Risk assets firmed, but the flow profile stayed controlled. | Equities advanced with volatility compressing, not expanding. | The VIX sliding to fresh lows signaled comfort, not enthusiasm. | This was positioning being maintained into a holiday-thinned tape, not leverage being added. | Rates reinforced that read. | Long-end yields edged higher without disturbing equities, suggesting real-money demand absorbing duration rather than traders fading risk. | Front-end expectations stayed anchored, keeping the curve stable and the equity bid intact. | FX was muted. | The dollar softened modestly, enough to support commodities but not enough to signal capital flight or funding stress. | There was no rush for safety… just a gradual easing of tightness. | Commodities carried the clearest flow signal. | Energy followed with a clean, policy-driven move, while broader commodity indices firmed without disorder. | Crypto tracked risk, not emotion. | Bitcoin pushed higher but stalled near a key psychological level, mirroring the broader market's lack of urgency. | Across assets, the message was consistent: liquidity is light, correlations are low, and capital is choosing where to be exposed, not how much risk to take. |

| |

| | |

| | | | Credibility Is Back on the Tape | Policy risk is no longer a headline event. It's turning structural. | Inflation is cooling, but not fast enough to force the Fed's hand. | Officials keep signaling patience, framing decisions around credibility and labor risk rather than market comfort. | In another cycle, that would read as stabilizing. | In this one, it doesn't. | The reason is governance, not rates. | The contest to replace the Fed chair has moved out of the background and onto the tape. | Names are circulating. Alliances are forming. | Markets are no longer just pricing the path of policy, they're pricing how policy decisions will be made and how insulated the institution remains from political pressure. | That kind of uncertainty doesn't clear quickly. Governance risk carries duration. | The same dynamic is showing up across policy channels. | The halt on offshore wind reframed energy policy overnight, shifting it from economics to national security. | That's a reminder that permission now matters as much as capital. | At the same time, the recall of dozens of U.S. ambassadors injects friction into trade, security, and commercial coordination just as global competition is intensifying. | Abroad, policy paths are diverging further. | Japan is tightening while much of the world still prices easing. | Europe remains cautious. | Synchronization has broken down, and with it the assumption of smooth, shared liquidity conditions. | Markets can operate with friction. | But they price it. | That's why dispersion is replacing direction. | And why protection continues to show up alongside participation. | Capital is demanding compensation for credibility risk. |

| |

| | |

| | | | $5 stock building Nvidia's AI servers | | Recently announced AI revenue will beat iPhone revenue in 24 months. | They build most of Nvidia's AI servers. | Still under $5. | See Alex Green's urgent alert → |

| |

| | |

| | | | Alphabet's Intersect Deal Shows How Capital Is Pricing Policy Risk | AI's constraint is no longer models or chips. It's power, permitting, and reliability. | Alphabet's acquisition of data-center and energy infrastructure firm Intersect isn't about scale for its own sake. | By pulling generation capacity and development timelines inside the balance sheet, Alphabet is reducing exposure to an increasingly uncertain external delivery environment. | This wasn't reactive. | Google already owned a minority stake and had been co-developing assets. | The deal formalizes a shift that's spreading across large platforms: reliance on external markets for critical inputs is becoming a liability. | Timing matters. | AI buildouts are colliding with grid constraints, permitting delays, and rising national-security scrutiny around energy assets. | In that world, speed without certainty becomes risk. | Control becomes insurance. | You can see the same behavior across markets. | Gold as a policy hedge. | Oil as an enforcement hedge. | Duration as a divergence hedge. | The implication is straightforward: | the next phase of AI leadership won't be decided by algorithms alone. | It will be decided by who can secure power, land, approvals, and timing certainty. |

| |

| | |

| | | | | | This is not a market breaking higher on belief. | It's a market staying invested while actively pricing uncertainty. | Risk remains on, but it's disciplined. | Leadership is narrow. | Protection is still being carried. | As liquidity thins and policy paths continue to diverge, the signal isn't fear or euphoria. | It's adaptation. | The rally remains intact. | But it's being hedged... deliberately. | That tells you everything you need to know about how this market wants to be owned. |

| |

| | |

|

|

No comments:

Post a Comment

Keep a civil tongue.