| TQ Morning Briefing | Markets Firm Ahead of PCE as Rate-Cut Odds Solidify | | | | | | The tape is doing something unusual.

It is moving higher without enthusiasm, drifting rather than charging, waiting for confirmation from a single data point that now sits at the center of every model on every desk: today's delayed PCE inflation report. | The labor picture is contradictory. ADP delivered the sharpest private-sector drop in more than two years. Challenger layoffs crossed one million for the year. But weekly claims collapsed to a three-year low, complicating the narrative at the worst possible moment. | Traders are treating that divergence as noise, not signal. The only thing that matters for the Fed next week is whether inflation is still edging lower. | Futures markets have made up their mind. A December cut is priced at nearly ninety percent. Momentum in rate-sensitive assets, from small caps to homebuilders to capital-intensive cyclicals, reflects the belief that Powell will validate that expectation, even if the committee remains unusually divided. | There is enough firmness in global equities, enough moderation in yields, and enough softness embedded in the labor data to keep the bias gently pointed upward into the weekend. | But everyone knows how thin that balance is.

PCE will either reinforce the path or challenge it.

The tape is steady, not settled. |

| |

| | |

| | | | Our #1 Coin for the Crypto Bounce | After weeks of brutal selling, the market is finally flashing green again. | Portfolios are recovering. The panic is fading. And most people will stop paying attention right here. That's a mistake. | Because relief rallies don't just lift prices… they reveal which cryptos have REAL strength behind them versus which ones were just along for the ride. | The weak hands have already sold. The panic sellers are out. What's left is a much clearer picture of where the smart money is actually flowing. | One crypto is now standing out as its fundamentals surge while price still lags. This is the same setup that led to past winners like 8,600%, 3,500%, and 1,700%+ gains. | See the #1 coin positioned for the next leg up (limited time). | © 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk. |

| |

| | |

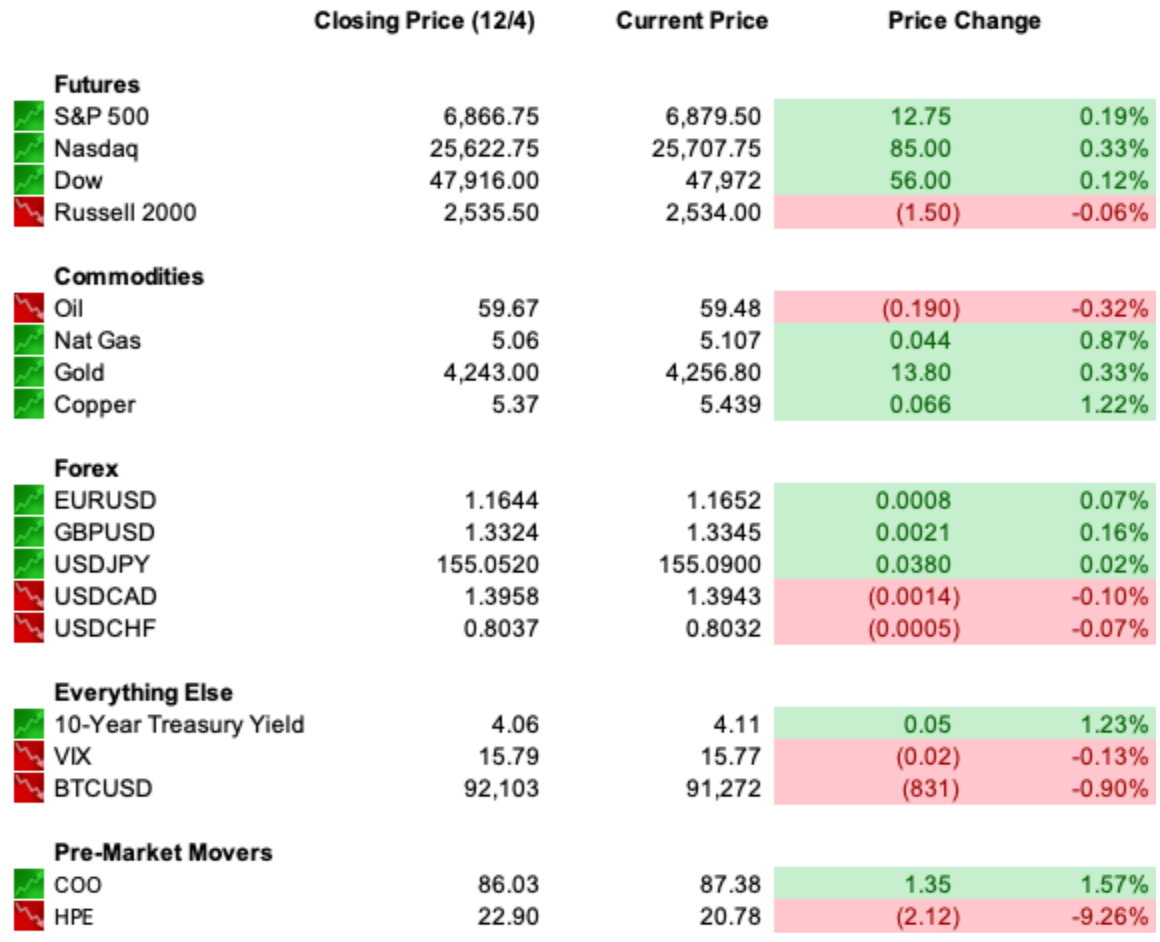

| | | | U.S. equities finished Thursday in a holding pattern, with the S&P 500 and Nasdaq logging modest gains while the Dow hugged the flatline. Rate sensitivity continued to dominate the narrative. The Russell 2000 rose another percent, its second strong session in a row, as expectations for next week's 25-bp cut solidified. | Sector performance reflected the same tension pulling through the data. Industrials and communications led. Healthcare, staples, and materials lagged. Volume remained light across desks, typical of the final trading stretch before a macro catalyst that traders agree carries asymmetric influence. | Bond yields drifted higher, with the 10-year near 4.11 percent as investors pulled back from the bid ahead of today's PCE release. The dollar snapped its nine-day losing streak but remains near five-week lows, pressured by expectations that the Fed will move ahead of global peers. | | Oil held steady on stalled Ukraine talks and broad geopolitical risk premia, while metals surged, copper toward new highs and silver continuing its sharp YTD run. | Futures this morning reflect that quiet confidence, with the S&P and Nasdaq higher by 0.2% and 0.4%, respectively, and the Dow and Russell 2000 effectively flat. | Treasury futures point to slightly lower yields, and the dollar remains weak against the pound and euro. Bitcoin sits just above $91,000 after an overnight slide. | Cloudflare headlines another global outage. Ulta jumps on guidance. HPE drops on delayed AI orders. Warner Bros. and Netflix enter exclusive deal talks. | The tone is constructive, not exuberant.

The entire market is running on partial information while waiting for the full readout at 10 a.m. |

| |

| | |

| | | | The rate narrative sharpened again overnight.

Fed expectations have now converged on a quarter-point cut next week, with Morgan Stanley joining JPMorgan and BofA in reversing their forecasts and acknowledging that policymakers' recent tone, and the incoming labor data, have tipped the balance. | Markets are treating the noisy labor readings as supportive of easing rather than contradicting it. ADP's 32,000 job loss and more than one million layoffs YTD from Challenger reinforce the view that the labor market is cooling meaningfully, even as weekly claims present an outlier of apparent strength. | Analysts largely attribute the claims figure to holiday distortions rather than underlying acceleration. | Today's delayed PCE report is the final hurdle. Core PCE is expected to hold at 2.8 percent with the headline number expected to drift slightly higher. If inflation moderates even marginally, it hands Powell the cover he needs to move, even with a divided committee and lingering hawkish dissent. | Globally, central banks remain on divergent paths. Japanese yields hit their highest level since 2007 as the Bank of Japan signaled uncertainty about how many additional hikes may be needed. The pound strengthened as U.K. markets priced in a slower easing path ahead of the ECB's fiscal conference. Divergence remains the defining feature of the global policy landscape. | | But for now, all roads point to Wednesday.

The cut is expected.

The messaging is not. |

| |

| | |

| | | | | Trade Winds & Global Shifts |

| |

|

| | | Russia and India deepened their economic alignment as Putin and Modi agreed to expand bilateral trade, diversify beyond energy, and finalize an economic cooperation blueprint through 2030. | Moscow is pushing for greater Indian exports to rebalance flows distorted by discounted crude. Modi reiterated support for a peaceful resolution in Ukraine while maintaining strategic autonomy between Washington and Moscow. | Tension flared inside NATO corridors as U.S. defense officials privately told European delegations that Washington wants Europe to assume the majority of NATO's conventional defense burden by 2027, a timeline many European diplomats described as unrealistic. | The message underscores the Trump administration's long-running push to reframe the alliance and could reshape the U.S. military role in Europe if not met. | Global cyber infrastructure absorbed another shock as Cloudflare suffered fresh outages affecting major platforms from LinkedIn to Coinbase to Substack. The rapid fix stabilized markets, but the recurrence has traders widening risk bands around companies dependent on third-party internet resilience. The outage follows a similar breakdown less than three weeks ago. | Across all three fronts, energy alliances, security architecture, and digital infrastructure, the market continues to price latent geopolitical fragility even as risk assets trade higher. |

| |

| | |

| | | | Retail Traders Guess. Pros Wait for This Signal. | Most traders enter too early… or five minutes too late. | The pros wait for confirmation—then strike with precision. | That's why one of Wall Street's most respected traders just released his FREE real-time trading indicator to the public. It's designed to spot high-probability breakouts, momentum shifts, and trend reversals as they form—not after the move is over. | If you've ever felt like the market moves without you, this is the tool built to solve that. | Get instant access to the FREE trading indicator here. |

| |

| | |

| | | | | D.C. in the Driver's Seat |

| |

|

| | | The Supreme Court is preparing to hear a major case that could overturn a 90-year precedent governing presidential control over independent agencies. Trump's firing of FTC commissioner Rebecca Slaughter is now the test case that could redefine the limits of executive authority. | A ruling that broadens presidential removal power would reshape regulatory stability across sectors from antitrust to consumer protection. | In a separate ruling, the Court reinstated Texas's contested congressional map, creating up to five new Republican-leaning seats and handing the administration a critical political win ahead of the 2026 midterms. | The decision signals where the Court's majority is willing to intervene, and where it is not, on partisan gerrymandering. | As legal and political battles escalate, markets continue to view Washington as a source of structural volatility rather than directional catalysts. The friction is persistent and increasingly priced into risk premia for regulated industries. |

| |

| | |

| | | | Core PCE Index

Michigan Consumer Sentiment

Personal Income |

| |

|

| | | | | | Asia: Nikkei -1.05%, Shanghai +0.70%

Europe: FTSE 100 +0.10%, DAX +0.63% |

| |

| | |

| | | | | | | | The market enters Friday's session with the same restrained confidence that has defined the week.

Futures are firmer.

Yields are steady.

Currencies are drifting.

Risk appetite is intact but cautious. | Everything now runs through the 10 a.m. PCE release. Confirmation of even modest disinflation keeps the December cut locked in and allows the recent grind higher to extend. A hotter print introduces doubt, not about next week's meeting, but about the path beyond it. | The tape is calm, but the stakes are not.

The next move belongs to the data. |

| |

| | |

|

|

No comments:

Post a Comment

Keep a civil tongue.