| |

| Silver to $500? Bestselling author Michael Maloney believes silver could surge as much as 2,400% to $500 in the coming years. This could be the biggest wealth transfer in world history. It’s critical for your financial future that you end up on the right side... That’s why I’ll send you a free copy of Michael Maloney’s book, the Guide to Investing in Gold and Silver, right now. It’s filled with the detailed information you need: where to buy silver, who to buy it from, which types of silver to avoid... Everything you need to know to profit is in this book. And it’s yours for FREE today. Is Silver Dead? By Nick Hodge | Monday, August 10th, 2015  Silver has been brutalized over the past four years or so. Blame it on the dollar's relative and unexpected strength in the face of rampant money printing... Call it paper manipulation by the big banks... Call it a losing propaganda war against precious metals as real money... Call it a lackluster global recovery that has subdued silver's industrial demand... Each of those ideas has some validity. But no matter where you stand on the reasons why silver has fallen, we must face the fact that silver has dropped 70% since the spring of 2011 while the S&P is up 53%.

It's like you've thrown three out of every four of your silver coins in the trash. Or is it? While the anti-bugs are busy pounding nails in metal's coffin, a peculiar thing happens if you go back just a bit further to a time before state-sponsored financial gerrymandering. Advertisement Urgent Opportunity: Tiny $1 stock about to go vertical A critical announcement on August 31st could send a virtually unknown $1.00 stock soaring 100-fold. But this play is already moving — and moving fast — for reasons you can see here. This year, it’s already up over 50%. Soon, it'll be too late. Please hurry now, or you’ll miss out on a real shot to retire rich in 2015. Take the chart back a decade, and you'll see that silver has provided returns higher than 250% — a selling time, not a buying time. Silver is up 115% compared to the S&P's 71% over the past 10 years:

Silver is up 194% compared to the S&P's 46% over the past 15 years:

The market doesn't catch up until you take the chart back two decades. Let's do that:

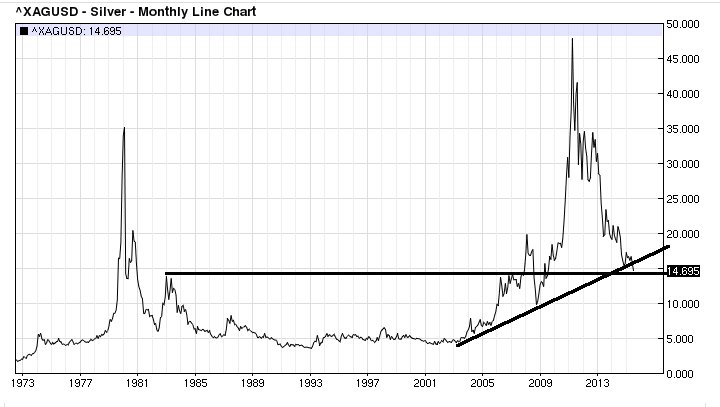

There you see that over a 20-year period, the S&P beats silver 272% to 191%. I would argue that will soon change. The chart says it, with silver needing to perk up a few dollars to get back to its short-term trendline, support right where it is now, and a climb to $50 not out of the long-term question.

The current global macroeconomic and financial conditions dictate it, with levels of debt that must either be defaulted on or inflated away — both of which are catalysts for higher metal prices. Advertisement A Little-Known Options Play Has Just Tripped the "R-4 Trigger" Which means that approximately two weeks from now, you'll have the chance to cash in for gains that could earn you $880 for every $1,000 you put in. Even better, you'll have the chance to do this about twice per month going forward. Though it went vastly underreported because the mainstream was busy cheering on falling metal prices, where do you think the inhabitants of the troubled Mediterranean nation turned last month when debt brought their financial system to a grinding halt?

Gold and especially silver have been debased and degraded so much over the past five years that when they break to the upside, they're going to do so in thunderous fashion. You need to understand why: the underpinnings, the reasons the current monetary frameworks are wearing thin, and how to safeguard yourself from it with precious metals. Remember, gold and silver aren't investments. They're a store of value, and they've done that well over the past two decades and, in fact, for much longer than the S&P has been around. They're insurance. They're crisis protection. And I'm of the firm belief you're going to need all those things in the coming years. This transitory period, while smoke is distorting the reflection of gold and silver's true value, is the time to get your policy. It is incredibly cheap right now. To help you understand those underpinnings more thoroughly, see why, when, and how metal prices will rise, and learn the best ways to deploy them for you... I'm giving away what I consider to be the “Bible” of precious metals: Michael Maloney's Guide to Investing in Gold & Silver. I did this earlier this year and quickly sold out of my stash of thousands of copies. So I went to Michael, and he updated the book and ran a new printing. Those copies just arrived in my office. I don't expect them to last long. So claim your free copy today. What's more, these new, updated copies aren't available anywhere else yet. You can get yours today for free before you can pay full retail price for it somewhere else. The stage is set for the return of the metal bull. Get your free blueprint for it today. Call it like you see it,

Nick Hodge Nick is the Founder and President of the Outsider Club, and the Investment Director of the thousands-strong stock advisory, Early Advantage. Co-author of two best-selling investment books, including Energy Investing for Dummies, his insights have been shared on news programs and in magazines and newspapers around the world. For more on Nick, take a look at his editor's page. The Bottom Line | |

This email was sent to ignoble.experiment@arconati.us . You can manage your subscription and get our privacy policy here. Energy and Capital, Copyright © 2015, Angel Publishing LLC, 111 Market Place #720, Baltimore, MD 21202. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. While we believe the sources of information to be reliable, we in no way represent or guarantee the accuracy of the statements made herein. Energy and Capital does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Neither the publisher nor the editors are registered investment advisors. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law. Please note: It is not our intention to send email to anyone who doesn't want it. If you're not sure why you're getting this e-letter, or no longer wish to receive it, get more info here, including our privacy policy and information on how to manage your subscription. | |

This site is an experiment in sharing news and content. Almost everything here came from email newsletters.

Sponsor

2015/08/10

Is Silver Dead?

@

09:10

Subscribe to:

Post Comments (Atom)

Label Cloud

Technology

(1464)

News

(793)

Military

(646)

Microsoft

(542)

Business

(487)

Software

(394)

Developer

(382)

Music

(360)

Books

(357)

Audio

(316)

Government

(308)

Security

(300)

Love

(262)

Apple

(242)

Storage

(236)

Dungeons and Dragons

(228)

Funny

(209)

Google

(194)

Cooking

(187)

Yahoo

(186)

Mobile

(179)

Adobe

(177)

Wishlist

(159)

AMD

(155)

Education

(151)

Drugs

(145)

Astrology

(139)

Local

(137)

Art

(134)

Investing

(127)

Shopping

(124)

Hardware

(120)

Movies

(119)

Sports

(109)

Neatorama

(94)

Blogger

(93)

Christian

(67)

Mozilla

(61)

Dictionary

(59)

Science

(59)

Entertainment

(50)

Jewelry

(50)

Pharmacy

(50)

Weather

(48)

Video Games

(44)

Television

(36)

VoIP

(25)

meta

(23)

Holidays

(14)

Popular Posts (Last 7 Days)

-

America's government has a renewed sense of urgency for tech innovation ...

-

It's Launch Day! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ...

Physical demand says it, with the pace of bullion-buying activity not being reflected in the paper price. The U.S. Mint sold out of Silver Eagles in July.

Physical demand says it, with the pace of bullion-buying activity not being reflected in the paper price. The U.S. Mint sold out of Silver Eagles in July. That article began:

That article began:

@nickchodge on Twitter

@nickchodge on Twitter

No comments:

Post a Comment

Keep a civil tongue.