| It was only about 8 1/2 minutes long. You could have missed it if you got up to get a coffee. But it was long enough to put the final nail in the coffin for the summer stock market rally we enjoyed this past June, July and August. Of course, I'm talking about the speech Federal Reserve Chairman Jay Powell gave on August 26 in Jackson, Wyoming. Let me briefly review the highlights of Powell's short address and then move on to what it means for investors going forward. The Speech That Killed It All With this speech, probably the most important of his career, Powell sought to finally and forcefully disabuse markets of the idea that the Fed would pivot to a neutral rate stance or even start lowering rates again later this year or early next. The ongoing optimism of investors this summer was undoing the impact of the Fed's recent rate hikes by making financial conditions easier, not tighter. So Powell was determined to wring the last bits of summer optimism out of the market and convince it that the Fed means business in its battle against elevated inflation. He emphasized several times that the Fed is absolutely committed to reducing demand in the economy via higher borrowing costs so that, eventually, demand comes into line with the limited supply of goods and services (which the Fed can do little about). Pain for All Powell also outlined the harsh consequences the Fed's planned course of action is likely to have, including... - A sustained period of slow economic growth

- Some softening of labor market conditions (read: rising unemployment)

- Pain for households and businesses (read: layoffs and lower profits).

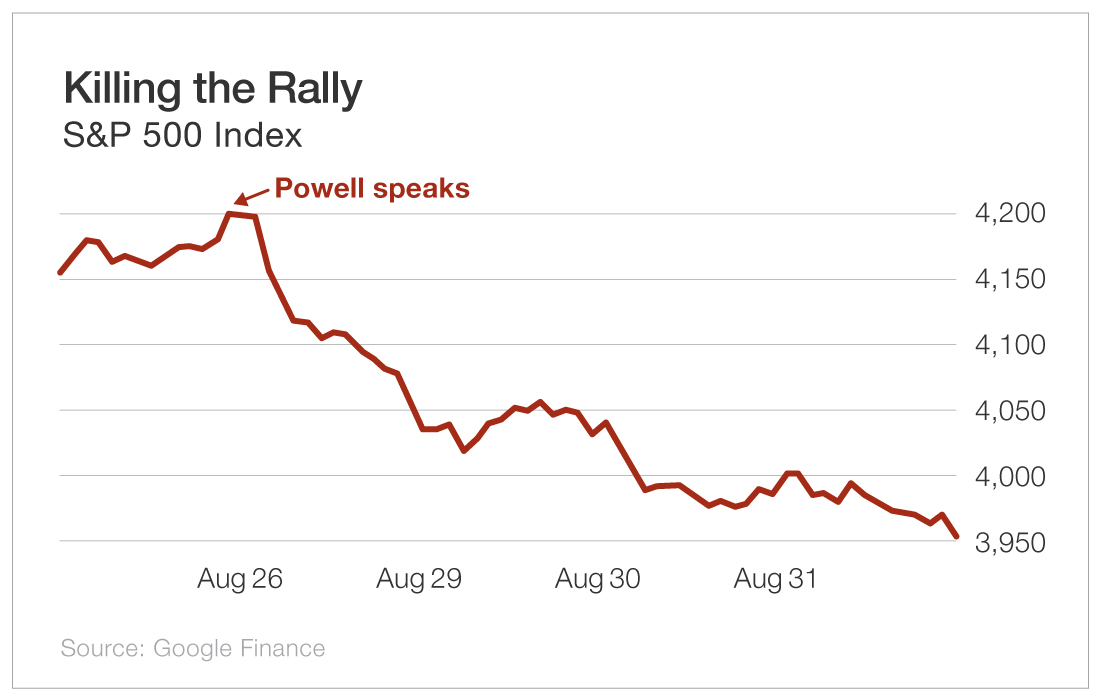

Powell didn't mention the stock market because the Fed is supposed to be steering the economy, not share prices. But it's no secret that another consequence the Fed desires is a market that goes sideways or lower - anything but higher. And while inflation moderated a bit in July - it was unchanged from June - Powell brushed the recent data aside. He noted that a single month's improvement falls far short of what he needs to see to be confident that inflation is coming down. He also emphasized that the Fed will likely maintain tight monetary policy "for some time." Read: Don't expect the Fed to stop raising interest rates anytime soon. Tall Paul Volcker Powell's speech mentioned former Fed Chairman Paul Volcker not once, not twice, but three times (twice in the speech itself, once in the footnotes). That was a coded signal to markets. "Tall Paul" - he stood 6-foot-7 - was intimidating and authoritative. He led the Fed from August 1979 to August 1987... and he had a spine made of steel. As you probably know, Volcker raised the Fed's target rate from about 11% to above 20% between 1979 and 1981 to combat runaway inflation. That pushed the unemployment rate above 10% and induced a recession. So it was no accident that Powell's speech last week invoked this imposing predecessor. Volcker also created the modern Federal Reserve, one that believes that its congressional mandate to maximize employment can be accomplished only if prices are stable. And Powell's speech reiterated this belief. So did the speech work? For the moment, it absolutely did. Below is a chart of the S&P 500 on the day Powell spoke and over the following days. You can see how the market tanked as soon as the text of the speech was published... And what now? Well, we're almost certainly in for another 75-basis-point hike when the Fed's interest rate setting committee meets on September 20 and 21. And probably another 50-basis-point hike in early November. Those hikes should keep a lid on the market for a few months. Right now, the futures market predicts the Fed will take its target interest rate up to almost 4% by December and keep it there at least through next July (the futures market doesn't go out further than that yet). As a result, we're likely to suffer all those consequences I outlined a moment ago. We can only hope they're not too dramatic or painful. Much will depend on the labor market and whether it cools off enough so demand for workers falls into balance with supply. So does Powell have the resolve of Tall Paul? It's too early to tell. Here's the upside: Volcker's aggressive inflation fighting helped launch a new bull market in August 1982 that lasted for five years and pushed the S&P 500 up 229%. Let's hope history repeats itself. Invest wisely, Matt P.S. If you want to know what other catalysts are likely to move the market in coming months, check out The Oxford Communiqué Pro. Every month, Chief Investment Strategist Alexander Green and I outline potential market movers in Market Outlook Monthly. Alex also records his State of the Markets Call each month to paint a clear picture of current market trends... and makes a bonus recommendation in his Profit Accelerator - which could help you cash in on the most attractive opportunities in the market. To find out more, go here. |

No comments:

Post a Comment

Keep a civil tongue.