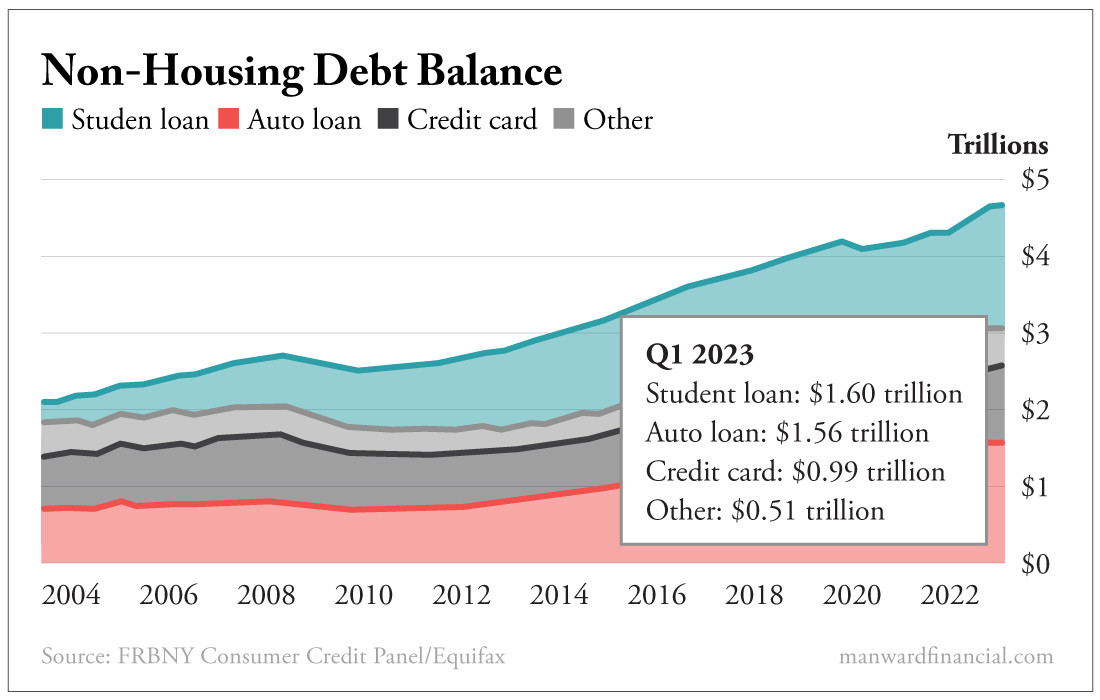

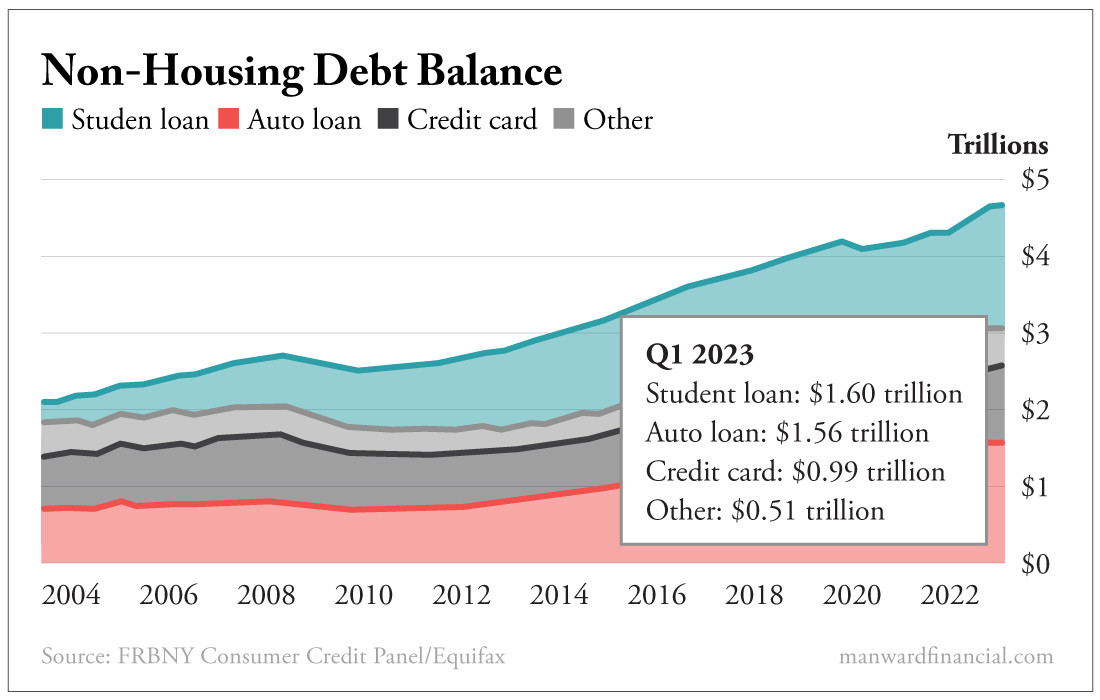

| | Alex Moschina | Consumer confidence is soaring higher than a Midwestern smoke cloud. But... why? According to the latest data from the Federal Reserve Bank of New York, some 102,000 Americans received bankruptcy notices in the first quarter. It was the first time quarterly bankruptcies crossed the six-figure mark since Q2 2021, a sign that all is not well with our nation's borrowers. [He's 2.5X'ed Berkshire Hathaway (Here's How...) ] ] Delinquent payments are also on the rise. As the NY Fed tell us, "Transition rates into early delinquency for credit cards and auto loans increased by 0.6 and 0.2 percentage points... Delinquency transition rates for mortgages upticked by 0.2 percentage points." But it isn't all bad. "[Delinquency rates] for student loans have remained flat," the central bank added, "as the federal repayment pause remains in place." (Gee, thanks, Uncle Joe!) Spending Gone Wild With everyone seemingly in agreement that money isn't actually real - and therefore doesn't have to be paid back - consumer debt has risen to brand-new heights. Total household debt now clocks in at a whopping $17.05 trillion. We highlighted America's rapid rise in auto loan debt a few weeks back, but it's only a small piece of the country's wobbly Jenga tower of financial liabilities. Mortgages make up the lion's share of our nation's debt ($12.38 trillion), and current credit card and other outstanding loan balances now total $4.66 trillion. And the numbers just keep on rising...

View larger image Why should anyone quit spending, anyway? It's All Good... Right? On Wednesday, our commander in chief told us that the U.S. economy is outperforming the rest of the world. Folks at the Cato Institute applauded the Fed's "reasonable" decision to pause rate hikes - temporarily - now that inflation has dropped below 5%. And our pals at The Wall Street Journal asked, "Where's the recession we were promised?" Hey, yeah... where is that thing? If you opened up our daily Digest on Thursday, you know that - despite all the recent hubbub - we're still not convinced that America is out of the fiscal woods. In fact, from where we stand, things are looking dark and wet... and we think we just heard something rustle in those bushes over there... In Andy's words: | There are only two ways out of such a clear calamity. Either we need to stop printing and let the growing economy absorb all of that money... Or that money needs to disappear... in the form of bad loans, bankruptcies and Fed money burning. The former is out of the question. | | | So, what to do? Our path forward is simple. Painful... but simple. If the Fed can't curb spending gone wild... not to mention soaring wages and a housing market that's (once again) on the rise... then inflation will continue to ravage the nation's wealth. Either way, the possibility of a recession still looms on the horizon. Americans will soon get the message that all is not well... one way or another. Sincerely, Alex While the global construction industry is feeling pessimistic, Alpesh has found a company in the sector that's been on an absolute rip since 2020. It's a specialty glass producer that has been growing profits at a 50% annual rate... yet the stock is dirt cheap. Get all the details - including the ticker - in this week's video. Click here or on the image below to watch it. For nearly 250 years, our nation has invested trillions of dollars, sacrificed hundreds of thousands of lives and reorganized the world's power structure just to defend this fragile but powerful line. But now, many folks believe we have crossed it... and become our own enemy - the thing we've loved to hate. Keep reading. "What can be added to the happiness of a man who is in health, out of debt and has a clear conscience?" - Adam Smith Want more content like this? | | | | | Alex Moschina Alex Moschina is the associate publisher of Manward Press. A gifted writer, editor and financial researcher, Alex's career in publishing began more than a decade ago when he worked at one of the world's leading providers of academic research and reference materials. Alex first cut his teeth in the realm of investing when he joined the team at White Cap Research in 2010. There he was charged with covering emerging market trends and investment opportunities. A stint as senior managing editor and editorial director at the prestigious Oxford Club followed. A frequent speaker at conferences and events, Alex has led educational workshops across the U.S. and Canada. | | | |

No comments:

Post a Comment

Keep a civil tongue.