[Editor's Note: Today is the last day that you can save money by attending the Physician Wellness and Financial Literacy Conference (WCICON24) virtually. Which means today is a great day to continue your journey toward financial success. Use the code "VIRTUAL" when you register for WCICON24 today, and we'll take $100 off the price. And it'll be well worth it. A virtual attendee can stream all the keynote sessions, 12+ breakout sessions, and nine additional virtual-only sessions, and you can get up to 16 CME credits. If you're looking to make an investment in yourself, sign up for the virtual WCICON24 (and save some money!) today.]

By Dr. Jim Dahle, WCI Founder

By Dr. Jim Dahle, WCI Founder

We have a tradition here at The White Coat Investor. Once a year, I like to write a post where we thank readers for trusting us with their time (and sometimes their money), review our conflicts of interest, and highlight what has been accomplished by the WCI community in the last year. I started it out back in 2012, calling it The State of the Blog, and the tradition endures.

A Huge Thank You!

Thank you to readers, listeners, viewers, students, attendees, community members, advertisers, and everyone else who has furthered the work of promoting financial literacy and wellness for physicians and other high income professionals in the last year—and really ever since this crazy thing was founded in May 2011. We've always known our growth was primarily from word of mouth: attendings telling residents, residents telling interns, interns telling students, students telling attendings, and patients telling doctors about the site and its resources. That was reinforced to me in 2023 after we did a couple of less-than-effective advertising campaigns. Let's just say a personal referral/introduction to WCI works FAR better than splashing some ads on screens in hospitals, on Facebook, or on Reddit.

Conflicts of Interest

We usually hit these at the end of this post, but this year we're going to do it right up front. We are hardcore believers in the WCI Vision and Mission statements:

We have also learned that the most successful organization to use to accomplish this mission is a for-profit business. I'm becoming more and more willing to work for free these days, but it turns out that none of our team members are. To make payroll (and keep me going on those days when I'm not willing to work for free), we have to generate revenue. We simply cannot make money without having conflicts of interest. However, we want you as a member of our community to be very much aware of those conflicts and how they can affect what you read, hear, and see at WCI. This list reads similarly to prior years, but it's a good reminder for all of us where the conflicts lie:

- We are incentivized to run content that relates to our advertisers' businesses more frequently than other content. The content team is mostly separate from the business team, but the conflict still exists.

- We are incentivized to accept guest posts from financial professionals who advertise with us more frequently than those who do not, despite our policy to judge guest posts purely on the basis of the content. We do our best to follow it. We run very few sponsored posts and only for a good cause (like the WCI Scholarship), and even those generally have exceptionally high content quality.

- We are incentivized to recommend you purchase term life and disability insurance policies through our recommended agents.

- We are incentivized to recommend you refinance your student loans when perhaps it would not be a good move for you. I don't think we've ever done this, but we are certainly incentivized to do so.

- We are incentivized to recommend you seek out professional help with insurance, financial planning, investment management, student loan advice, purchasing and selling real estate, negotiating contracts, getting burnout coaching, and preparing your taxes when perhaps you could do some of that on your own.

- Since we have real estate advertisers, we are incentivized to discuss real estate investments more frequently than we otherwise might or more than we discuss traditional investments like index funds or alternative investments for which we do not have advertising partners. Let's be honest, we could get advertising partners for EVERY alternative investment out there, and we routinely turn many down. What we can't seem to do is get Vanguard, Fidelity, Schwab, or iShares to advertise their index funds here.

- We are incentivized to accept advertisers who do not meet our high standards for recommendation to friends and family. We are constantly vigilant to minimize this conflict.

- We are incentivized to recommend you read financial books, including and especially our own.

- We are incentivized to recommend you take our financial courses and those of our affiliate partners.

- We are incentivized to recommend you attend WCICON.

- We are incentivized to encourage you to purchase from the WCI Store.

- We are incentivized against recommending content by others who have the same affiliate marketing partners or who compete for the same advertisers.

- We are incentivized to recommend you use the WCI forum over other forums, the White Coat Investors Facebook group over others, and the WCI subreddit over other subs.

That's actually fewer conflicts than last year. Nice!

2023 Accomplishments and Notable Events

The Blog

This is where it all started, and we're now into Year 13. As you've noticed, it's not just me anymore. We have columnists including:

- Josh Katzowitz (our content director)

- Alaina Trivax

- Charles Patterson

- Francis Bayes

- Rikki Racela

- Margaret Curtis

- Joy Eberhardt De Master

- Daniel Smith

- Anthony Ellis

- Tyler Scott

- Julie Alonso

and paid contributors including:

- TJ Porter

- Jamie Johnson

- Dan Miller

- Joe Dyton

- Eric Rosenberg

- Phil West

and dozens of unpaid guest posters that helped me to provide content on the blog. Including the podcast show notes (doesn't Megan do a great job with those?) which run every Thursday, we "hard publish" about 28 blog posts a month (6-7 a week). However, most of what the contributors write isn't hard published on the blog and is found primarily by people coming from search engines. We also occasionally delete or combine previously published content (quite a bit actually in the last year).

In total, we now have 3,140 pieces of content on the site. That's an increase of 6.3%. The website had 8.4 million pageviews in 2023, a slight (2%) decrease from 2022. However, we had 4.2 million visits from search engines this year, a 4% increase, while 3.6 million unique people came by the website this year, a 2% decrease. While those percentages aren't anywhere near what they were in 2011-2016, the sheer numbers are dramatically higher. Trees don't grow to the sky and you've probably noticed that every year there are fewer and fewer docs who have never heard of The White Coat Investor. There is also the natural trend away from blogs and initially toward podcasts and now video. People are just reading blogs less and less often, and that affects us too. Our most popular post this year was again The Backdoor Roth IRA Tutorial (196,000 pageviews) with honorable mentions going to:

- How Much Do Doctors Make per Year?

- 2024 Retirement Plan Contribution Limits

- How Much Money Does a Doctor Need to Retire?

- Surveys for Money

- Physician Disability Insurance

Our most popular post actually written this year was by StudentLoanAdvice.com guru Andrew Paulson, entitled The Loophole That Can Get Thousands of Doctors into PSLF.

The Newsletters

We send out a lot of emails. Most of these are email copies of the daily blog posts (almost 30,000 of you get these) or an occasional marketing post ("Hey, Buy Our New Course" or "Come to WCICON!"). But there are two special emails that go out every month—the WCI Newsletter started in 2012 and the WCI Real Estate Opportunities Newsletter started in 2020.

We don't want to send you emails that you don't want, so we're actually pretty ruthless about these email lists. If you don't open emails from us for a few months, we send you a series of three emails asking if you really want them. If you don't click on a link in those emails, you're removed from the list. This helps keep the "open rate" high (80%+ for the newsletter) and ensures emails get delivered into white coat investor email boxes. Despite that draconian policy (and lots of people who unsubscribe because, heaven forbid, we invited them to come to our conference), we still saw the WCI Newsletter list grow to 65,615 (a 7% increase) and the Real Estate Newsletter grow to 14,242 (a 14% increase). By the way, you can subscribe to all of our email lists here.

The Podcasts

We have now put out 497 White Coat Investor and Milestones to Millionaire podcasts, an increase of 104 (two per week) from last year. We had 5.41 million downloads this year (a 29% decrease), and we are averaging 45,565 downloads per episode. We have more than 20 million all-time downloads. We have had 2,227 reviews averaging 4.8 stars, and we rank No. 35 for investing (up from No. 37) podcasts on Apple. I don't know what to make of the data that shows we're more popular than the year before but had fewer downloads. I guess people were listening less to investing podcasts in general in 2023 than in 2022.

The Videocast

People are definitely moving more toward video, and we're putting increased effort into that every year. The WCI YouTube channel continues to grow, with 415 more videos published this year for a total of 1,400 (a 42% increase). We now have 25,492 subscribers (a 24% increase), and we have had about 1.5 million views of our videos—including 476,000 in 2023, a 14% increase from the prior year. Too bad I'm not nearly as good at video (or podcasting for that matter) as blogging.

WCI Communities

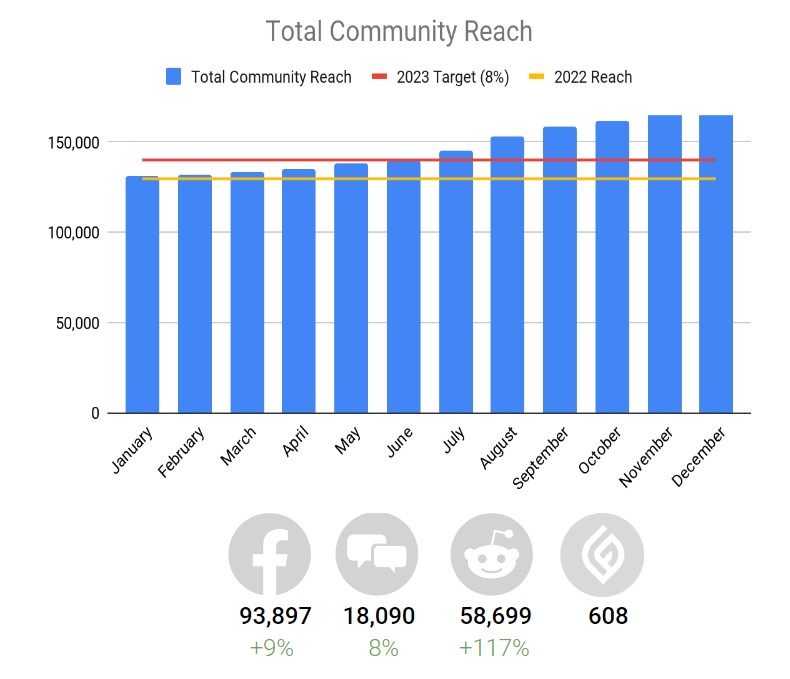

The WCI Forum is now more than 8 years old and is clearly the WCI community that caters to the more experienced WCIers. There are 18,090 members (an 8% increase). We had 287,846 unique visitors there this year, so obviously most people there are lurkers who have never registered as members. Thank you to our volunteer moderators there: ACN, DMFA, Doc Spouse, Hank, Hatton JFoxCPACFP, Jim, Larry Ragman, CordMcNally, MPMD, Kamban. Moderating can be a thankless task.

The WCI Facebook group now has 93,897 members (a 9% increase) talking about all kinds of fun stuff as usual. Thank you to our volunteer moderators there: Andrew Parada, Paula Archer, Donna White, Diem Ephee, Greg Morgan, and Bill Yount.

The WCI subreddit was one of our big wins this year. There are now 58,699 members there, a 117% increase. Thank you to the volunteer moderators there: DrPayItBack, TossedObject, and RadOncDoc.

The Financially Empowered Women (aka The FEW) is new this year. The brainchild of the female staff members here, this has been a smashing success as well. This group for women held several awesome evening online events with great speakers and discussions afterward. There are 1,627 women in the group now (including 608 in the FEW Facebook Group), and there will be a special in-person event for the group at WCICON24.

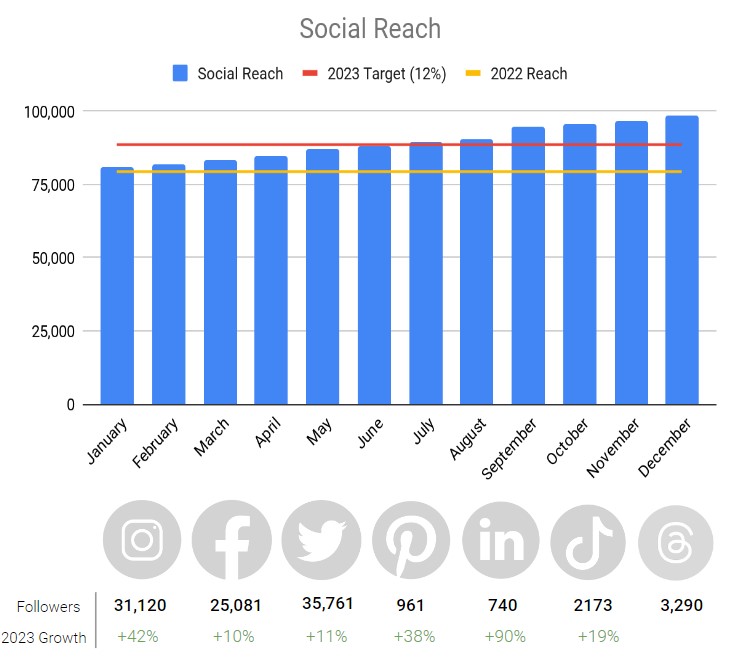

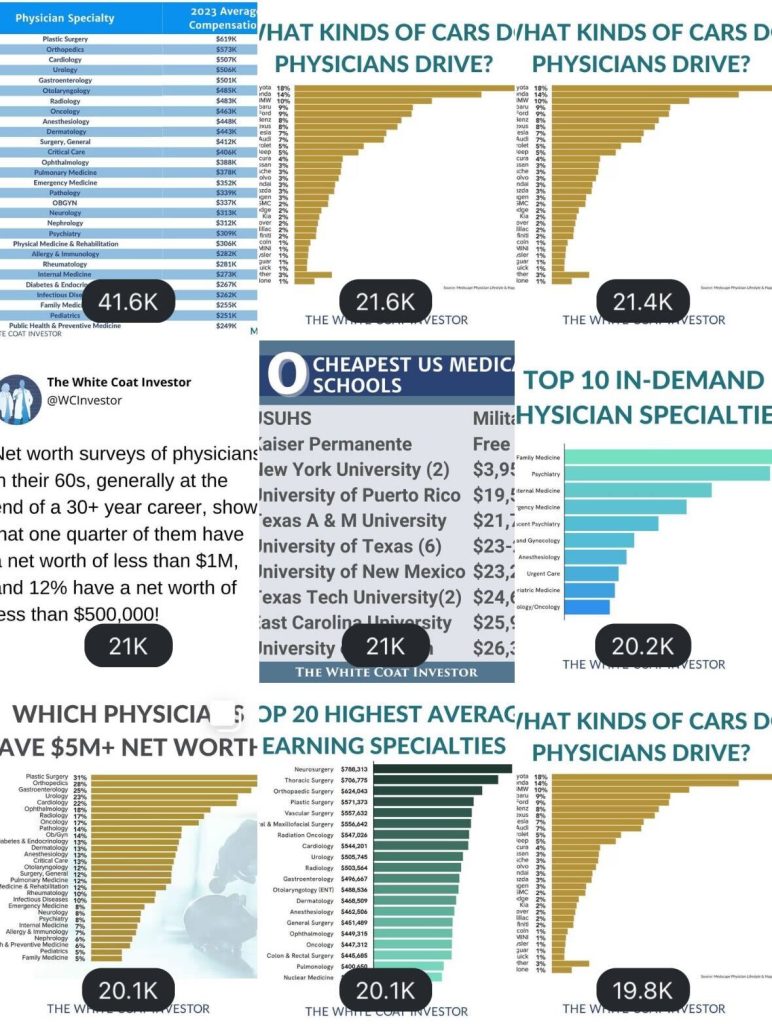

Social Media

Social media can be tough to keep up with, but it's important for us to bring you financial education in whatever format you prefer it. Our staff is great at converting whatever material is produced for the blog, newsletters, podcasts, and video casts and getting it out there on social media. Here's a summary of how we're doing:

Instagram was a bright spot in 2023. It's always fun to see what you guys like there.

Here are the most frequently shared Instagram posts in 2023:

and the most popular Instagram stories for 2023 . . .

Books

A surprisingly high number of white coat investors had their first exposure to WCI via one of our books. They continue to sell well each year, and they are prettier than ever. Although I didn't write any new books this year, the original "Doctor's Guide" book and the student loan section of the "Student's Guide" book were updated.

- The White Coat Investor: A Doctor's Guide to Personal Finance and Investing (2014) sold 10,857 copies, a 29% increase. It went up to No. 5 in its category on Amazon.

- The White Coat Investor's Financial Boot Camp: A 12-Step High-Yield Guide to Bring Your Finances Up to Speed (2019) sold 3,017 copies, a 19% decrease. But it also increased to No. 12 in its category.

- The White Coat Investor's Guide for Students: How Medical and Dental Students Can Secure Their Financial Future (2021) sold 667 copies (plus almost 16,000 more given away) and ranks No. 46 in its category.

- The White Coat Investor's Guide to Asset Protection: How to Protect Your Life Savings from Frivolous Lawsuits and Runaway Judgments (2022) sold 1,820 books, down 41% but still No. 1 in its category of Family and Health Malpractice Law.

WCI Courses

Online courses, along with the conference, are our "premium products." We have big plans for some additional courses in 2024, but our established courses continue to help WCIers every day. We sold 1,223 courses this year. These are the current courses for sale.

- Fire Your Financial Advisor (our flagship course to help you become financially literate and write your own financial plan)

- Financial Wellness and Burnout Prevention for Medical Professionals (the best way to buy FYFA using CME money)

- No Hype Real Estate Investing (a broad review of the spectrum of real estate investing from fix-and-flip, short-term rentals, and long-term rentals to syndications, funds, and REITs)

- Continuing Financial Education (CFE) 2023 (The CME-qualified online version of our WCICON23)

- Continuing Financial Education (CFE) 2022 (The CME-qualified online version of our WCICON22)

Physician Wellness and Financial Literacy Conference

We had our best-run conference ever, our second in a row at the JW Marriott just north of Scottsdale, Arizona. It was awesome! We had wonderful content, wonderful wellness activities, plenty of networking and friendmaking, and some fantastic food. We actually had slightly fewer people attend than in 2022 (especially virtually, I think many people are kind of done with that) so those who came got even more personalized attention. This year, we've changed it up a bit. We're in Orlando from February 5-8 for all you East Coasters, and it's not too late to register! Bring the kids, come early or stay late, and go see Disney World!

WCI Store

We had 1,183 orders (a 16% increase) from the WCI Store this year.

Speaking and Writing Gigs

I continue to write for ACEP NOW periodically, and we actually have a special all-day free workshop planned the day before The ACEP Scientific Assembly this year. I'll be speaking at the assembly again in 2024 after a two-year hiatus. We didn't do a very good job of keeping track of all of my appearances this year (Katie tells me I did two in-person and two virtual presentations), but probably the biggest thing we did was become very involved in the Bogleheads Conference. Given her experience with WCICON, Katie pitched in behind the scenes to keep their biggest conference ever organized. I was again in charge of the entire first day (Bogleheads University) and was on stage a couple of more times after that. It was so nice to spend the last day in the audience just learning.

Student Loan Advice

StudentLoanAdvice.com was one of our big wins this year, perhaps the biggest. It feels like we had been spinning our wheels there for a couple of years during the federal student loan holiday. That came to an abrupt end, and the number of consults needed by WCIers 6Xed seemingly overnight. Andrew Paulson, our chief consultant there, worked like a resident to keep up, and we brought in his spouse for some additional administrative help. WCI columnist/dentist/financial advisor Tyler Scott lent a hand as well. Growth is always a good problem to have, and we certainly had that with SLA this year.

WCI Network

As expected and planned, the WCI Network came to an end this year. These partnerships with other physician financial blog owners were designed to last 3-7 years, and although our partnership with The Physician Philosopher wrapped up a little earlier than that, the ones with Physician on FIRE and Passive Income MD reached all the way into the seventh year as successful partnerships. POF was sold to new owners shortly after I was bought out, but PIMD continues under the sole ownership of Dr. Peter Kim. We enjoyed these multi-year collaborations and wish these companies all the best as they work to help physicians find financial success. I'm proud of what we accomplished in our time together.

Outreach Efforts

These are some of the things we are most proud of here at WCI.

WCI Champions Program

Perhaps the most important thing we've ever done is distribute a copy of The White Coat Investor's Guide for Students to every first-year medical and dental student in the country, via a "champion" in their class. The champion gets a WCI T-shirt and possibly a WCI tumbler but, more importantly, provides a lifetime value of perhaps nine figures to their classmates. If your class doesn't yet have a champion for the 2023-2024 school year, sign up here. For 2022-2023 (the class of 2026), we gave away 15,660 books (a $469,017 value) at 114 schools and hope to do even better this year. We're even willing to give it to classes that aren't medical and dental students.

WCI Scholarship

While Katie and I have established a permanent pre-med scholarship at our alma mater, also called The White Coat Investor Scholarship, that's not The White Coat Investor scholarship we're talking about here. This one is funded annually by us and blog sponsors. This year we gave away $5,945 each to 10 scholarship winners in two categories (Inspirational and Financial). Congratulations again to the winners:

- Amanda Watters

- Taka Nah Jelah

- Aidan Kaspari

- Sara Yousef

- Payge Barnard

- Abigail Miller

- Hannah Kilbride

- Jessica Sidrak

- Jenny Wang

- Charles Grafe

and thank you to the sponsors, especially the platinum level sponsors.

- Larry Keller (Physician Financial Services) – Disability and Life Insurance

- Michael Relvas (MR Insurance) – Disability and Life Insurance

- SoFi – Student Loan Refinancing

Financial Educator Award

This year's WCI Financial Educator Award (along with its $1,000 prize) went to Dr. Cyril Varghese. Congratulations again!

Free Student Webinar

I get invited to speak at lots of medical schools and residencies. Most of them can't afford to fly me out, much less pay me to come. I have to turn most of them down, so once a year, I try to reach them all virtually at the same time with a webinar. This has been a big success in the past, so we're going to do it again on February 21 at 6pm MT. Sign up here!

Charitable Giving

We've had WCIers help direct some of our charitable giving at times in the past. We didn't do that this year (we wrote a huge Charitable Giving pillar post for Christmas Day instead), but a big chunk of WCI profits went to charities anyway. Some of the charities supported this year include:

- Utah Food Bank

- Mt Orab United Methodist Church (Food pantry)

- Heifer International

- Henry Hosea House

- Fourth Street Homeless Clinic

- Against Malaria Foundation

- Nurturing Nations

- TB Alliance

- Tribal Outreach Medical Alliance

- Save the Children (Ukraine-specific donation)

- The Road Home

- Utah Refugee Connection

- Catholic Community Services of Utah

- Tim Tebow Foundation (Trafficking specific donation)

- Coalition to Abolish Slavery and Trafficking

- Fortune Society

- GiveDirectly

- Trevor Project

- Wikipedia

WCI as a Business

Yes, despite all of the outreach and giving mentioned above, WCI is still a for-profit business. Once more, we were successful in generating a substantial profit this year. However, for the second year in a row, our profit was less than the prior year. Our top line (revenue) declined by 20% and our bottom line (profit) declined by 29%.

As you can imagine, that has caused a lot of soul-searching at the company, although certainly not any particular level of fear. While it's hard not to have at least a little concern that this could be the start of a trend, even a pessimist like me can recognize that a significant part of those declines was simply due to the economic environment. Rapidly climbing interest rates (especially BEFORE the student loan holiday ended) had a larger effect on our revenue than I had expected. WCIers (along with everyone else) are refinancing student loans much less than they otherwise would, refinancing their mortgages much less than they otherwise would, and buying fewer homes and investment properties than they otherwise would.

The effect of higher interest rates on the returns of real estate investors has also had a souring effect on the sales of our real estate course and the ability of our real estate partners to raise money. People just aren't as interested in real estate investing as they were the last few years when returns were through the roof. Expenses that rose with inflation also took their toll. Free content businesses are struggling across the internet. I've noticed that even big news sites like CNN and Fox News are putting more and more content behind paywalls these days, because display advertising just isn't paying the bills.

The good news is that I think we're pretty stable where we're at in the product lines that were hit hard this year, and we've got some product lines that hold a lot of promise moving forward. We're also finding some "fat" to cut that will help profitability (turns out advertising on hospital computer screens probably isn't very effective). I expect to grow our profit in 2024, and if interest rates ever decline significantly, we should have a big tailwind at our back.

I'm not sure that positive outlook is the case for many other companies in this space. We have competitors that also compete with us for content, and we have competitors that just compete with us for dollars. We keep pretty close tabs on all of them, and 2023 has seen a major one go completely out of business and several others that are on the rocks. Unlike 2016-2017 when 100+ physician finance blogs popped up, there have been almost none that have started up in the last couple of years, and even the more successful ones have generally cut back on either the quantity or the quality of what they're putting out. The golden age of physician financial blogs as a business is likely over, but as the biggest player in the marketplace, we're not going anywhere anytime soon.

I also console myself with the fact that given how burned out I was at the end of 2019, everything since then is really icing on the cake—both financially and as far as promoting our mission. We've likely helped more docs SINCE I burned out on WCI in 2019 than before. The fact that Katie and I don't live on the money that comes from WCI (and never really have) allows for an awful lot of flexibility when it comes to the financial aspects of the business. Most importantly, it allows us to ensure that business decisions align with our mission—even when that results in less revenue, at least in the short run. It also allows us to prioritize the financial lives of our staff members with great incomes, top-notch benefits, job security, and an incredible working environment. We haven't had a profit every month, but we're proud to have met payroll every month for the last 112 straight months. Although we didn't do a WCI retreat in 2023 (we went to Jamaica in 2022), we have a week at Lake Powell in houseboats planned for 2024.

Staff Changes

We had two new hires in the tech department in 2023—a contractor by the name of Rafael who lives in Brazil and an employee by the name of Travis here in Utah. We have another Travis, a former Guardian executive, who was hired to assist with our insurance product line, keeping the trend going of having multiple people in the company with the same name for maximum confusion. We now have two Jameses, two Katies, and two Travises.

All but one of our 18 staff members and many of our columnists will be at WCICON in February if you'd like to meet them. WCI Ambassador Disha Spath went back to her work at The Frugal Physician this year (she started a podcast!), and we wish her well there and thank her for her contributions to WCI while she was with us. With three new guys on staff and one fewer lady, for the first time in nine years, we are no longer a company where the majority of staff are women. As columnist Rikki Racela would say, we're now "nine dudes and nine dudettes."

Connecting You with Best in Class Financial Resources

As you will recall, the first part of our mission is to provide you with an awesome financial education. The second is to get you the best financial resources out there. Major updates continue to be done behind the scenes to refine this aspect of WCI—all to serve you better.

While our relationships with all of these partners help us to make payroll and to be a profitable business, we also see it as a valuable service. We connect you with the good guys in the industry and help run the bad guys out of business. When you need these services, we would appreciate it if you would at least consider using those who advertise on the site. They've had some preliminary vetting by us and some ongoing vetting by your fellow readers. You can find most of them under the recommended tabs at the top of the site.

-

- Student Loan Refinancing Companies

- Mortgage Lenders

- Independent Insurance Agents

- Financial Planners and Asset Managers

- Physician Coaches

- Retirement Account Providers (Self-Directed IRAs, 401(k)s, HSAs)

- Real Estate Investing Companies

- Student Loan Advice

- Contract Negotiation and Legal

- Tax Strategists

- Realtors

- Surveys for Money

- Credit Cards

A surprising amount of worry, heartache, and difficult decisions come from building and maintaining these lists. Feedback from you is the main driver of who stays on these lists, so please share with us when you have a good experience with someone. And if you're not having a good experience, let us know ASAP, and we can often get things turned around faster than you might expect. While service and responsiveness are generally awesome across the board, bad service rapidly improves when the company hears from us. We're serious about getting you a fair shake on Wall Street. There is no company we won't cut ties with if they're not treating WCIers right, no matter the financial consequences.

While there were a few more negatives in 2023 than in prior years, WCI still had a fantastic year. We're proud of our work, and we're proud to have you as part of the WCI community.

What do you think? What did you enjoy most on The White Coat Investor in 2023? Comment below!

The post State of the Blog 2024 appeared first on The White Coat Investor - Investing & Personal Finance for Doctors.

Be sure to Refinance Your Student Loans, sign-up for our Online Courses, and listen to the WCI Podcast!

Unsubscribe from these daily financial articles

Manage all your subscriptions

If you NEVER want ANY emails from us again, you can unsubscribe from EVERYTHING | Update your email address by clicking here

White Coat Investor | P.O. Box 520421, Salt Lake City, Utah 84152

No comments:

Post a Comment

Keep a civil tongue.