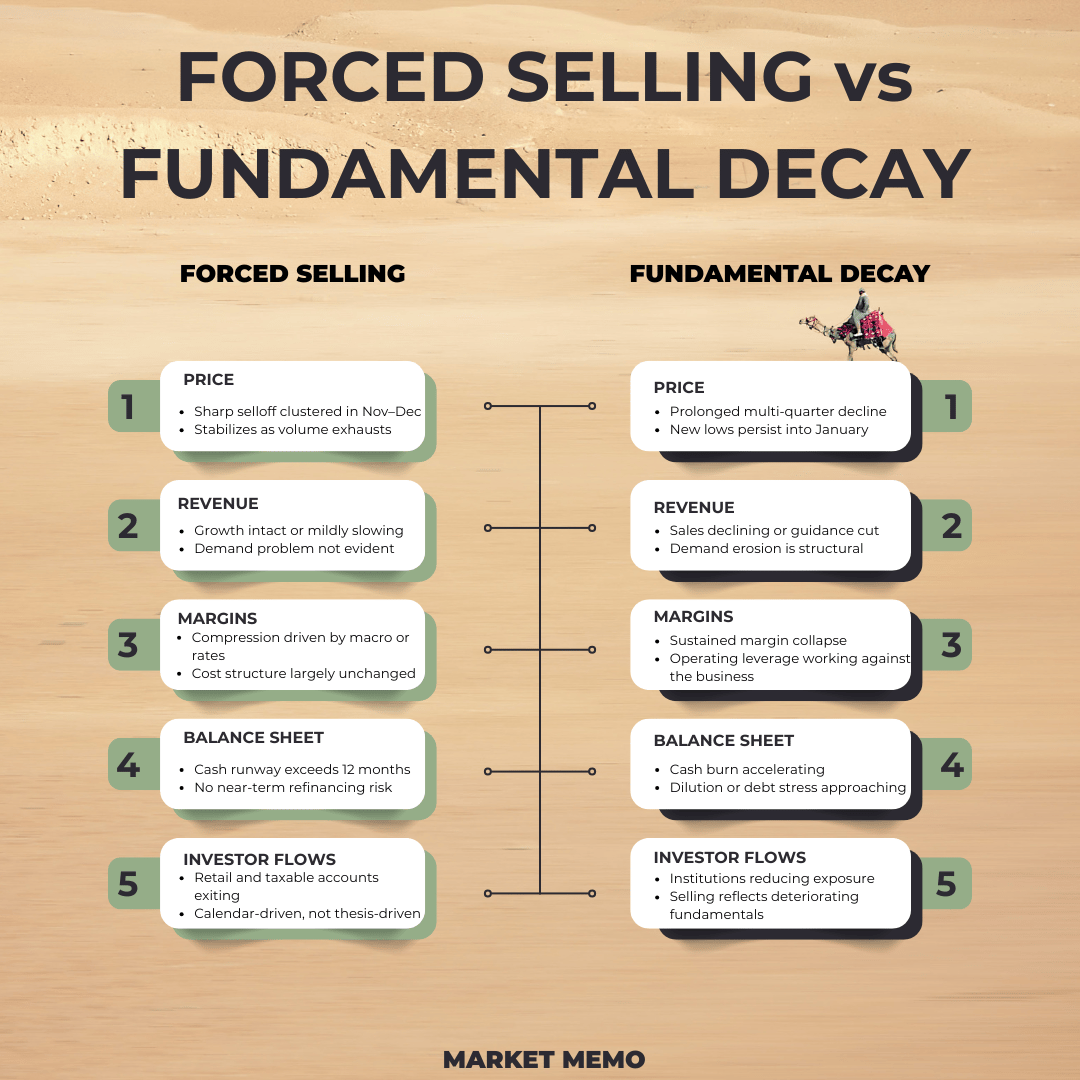

Last December, hundreds of stocks dropped 40%+ as investors dumped losers for tax write-offs. Bargain hunters jumped in, convinced they'd found gold at discount prices. By March, many were down another 30%. | That wasn't bad luck. Those were value traps. | Every year in December, the same pattern repeats. Investors see a stock that is down 40–60% for the year and assume that tax-loss selling is the reason for its decline, and they see the stock continue to decline even after January. |

|

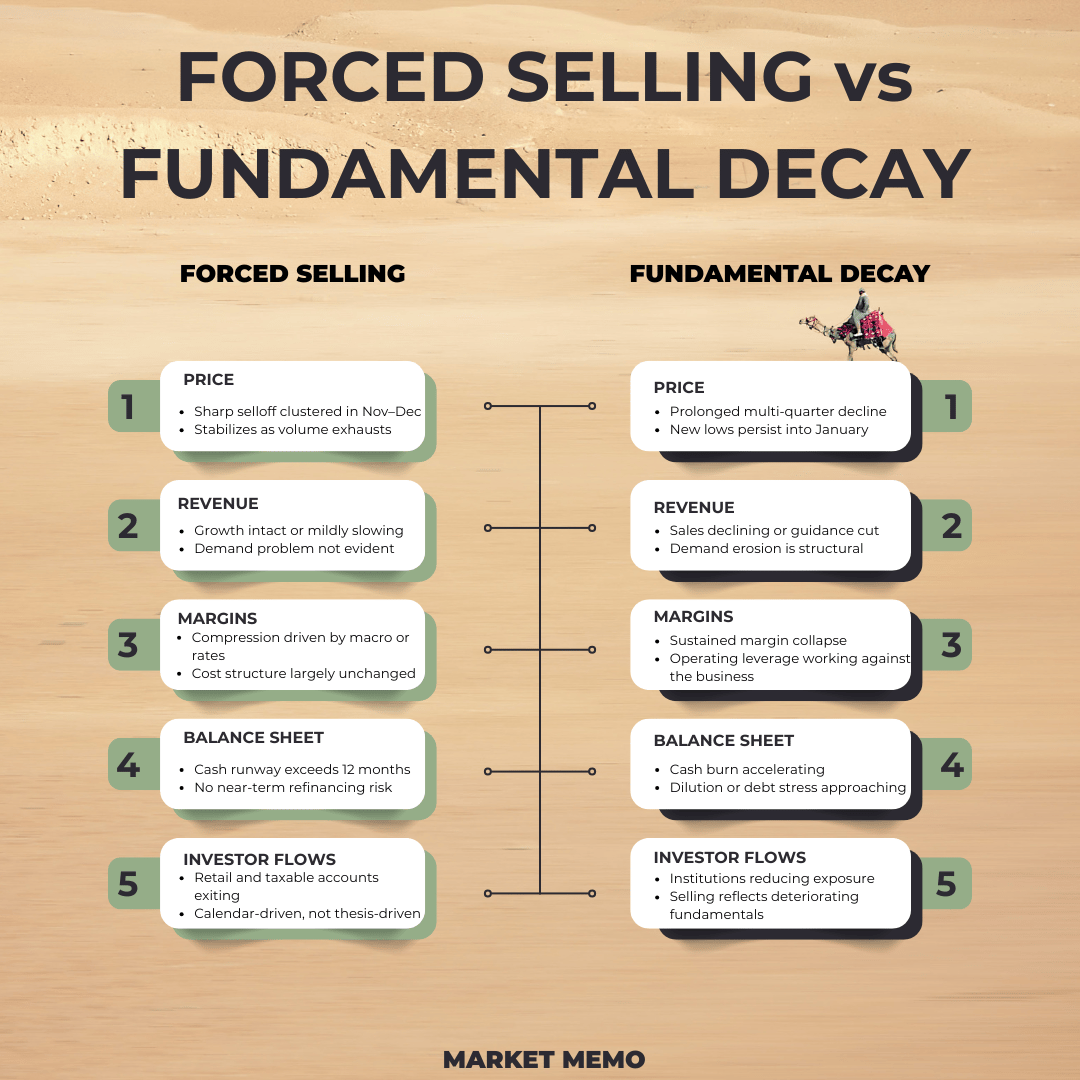

| | Tax loss season is the season of opportunities. To fully utilize that opportunity, you must know what forced selling is and fundamental decay. Here's how to spot the difference. |  | Forced selling vs fundamental decay |

| The good news? Identifying them is relatively easy and free of cost. Here is a tool that could make your life easier, if you haven't been using it already. |

|

| | | | | Many companies partnering with Nvidia have seen their own stocks go up … | That includes ASML, up 4,501%. | Synopsys, up 3,745%. | And Taiwan Semiconductor, which has soared as much as 9,793%. | You won't find these companies anywhere in Nvidia's official Partner Network. | That's why I call them Nvidia's "Unauthorized" Silent Partners. | In 2026, a new set of them is poised to benefit. | Find out who they are right away. |

| |

| | |

| 5 December Value Traps to Watch Out For | Value Trap 1: The Shrinking Business Trap | When revenue is declining from YoY and QoQ, that is not tax-driven December selling, but it is investors exiting a broken growth story. The following are the key characteristics of the business. | | Here is a Finviz filter that you could use to identify such companies, if you have them in your portfolio. | FINVIZ Filters (Shrinking Business) | Performance | | Fundamentals | Sales growth (Past 5Y): Negative Sales growth (QoQ): Negative EPS growth (Next Year): Negative

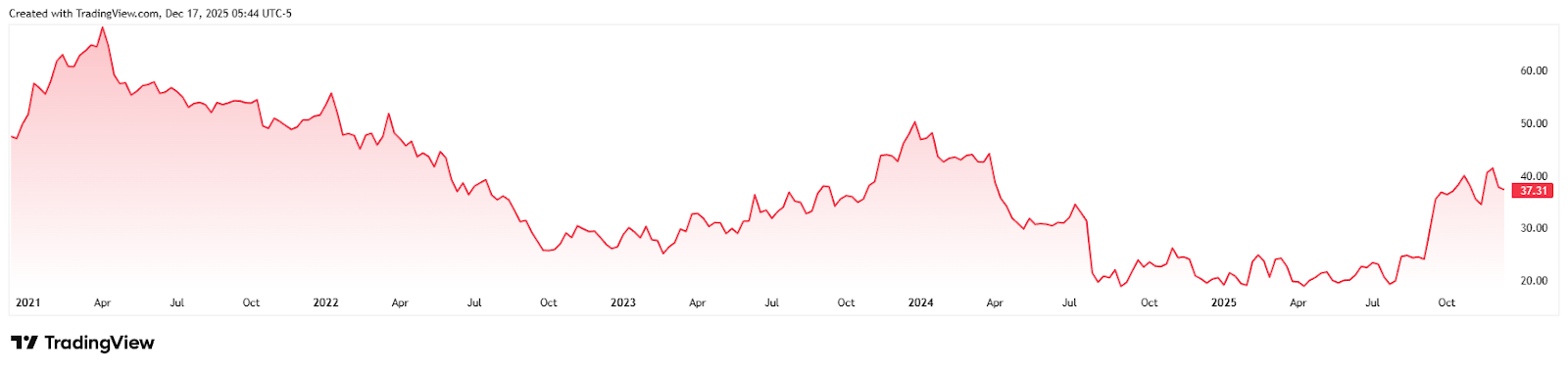

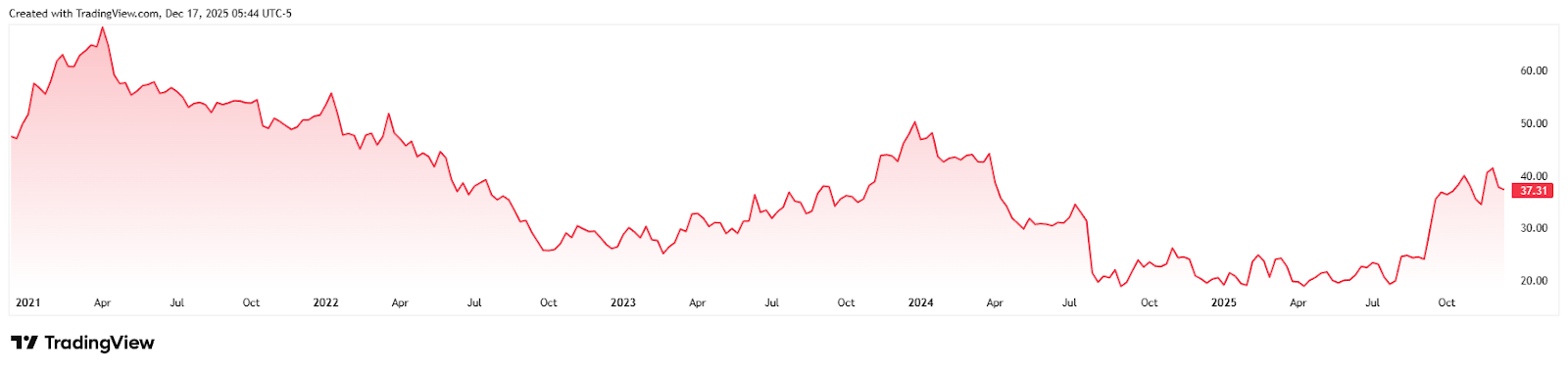

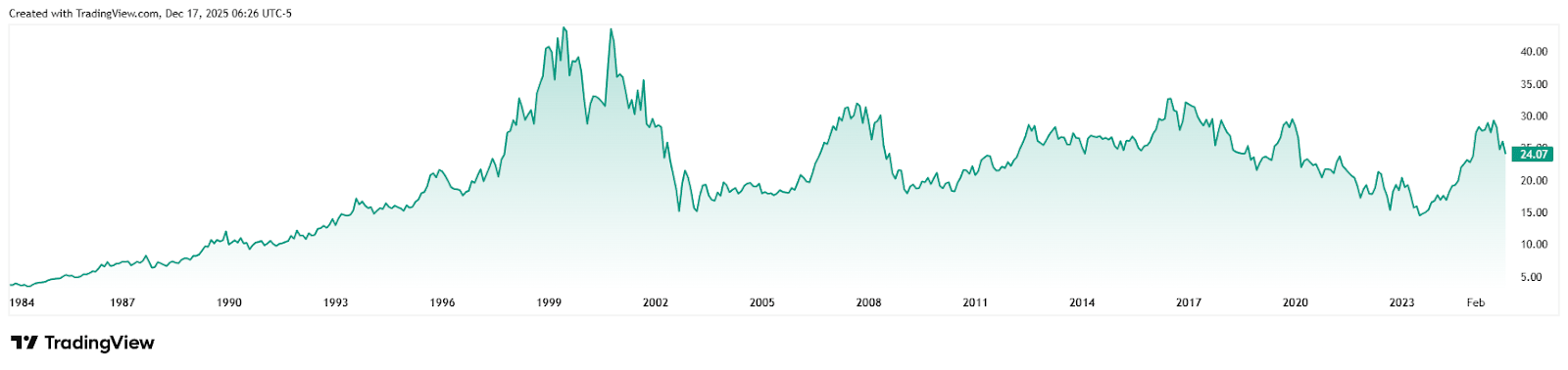

| Valuation | | One of the best examples of this trap is Intel (INTC) from 2021 to 2023. They experienced declining revenue for multiple quarters and lost their data center share to AMD. Investors thought the valuation was cheap, but the EPS continued to fall, and it has now stabilized at a 40% decline from the previous highs, despite AI/Tech headwinds. |  | Last five years ' stock price of Intel (INTC) |

|

|

| | Value Trap 2: Compressing Margins | The second value trap is where revenue holds up, but profitability is structurally flawed for quarters and even years. The following are the key characteristics of the business. | | Here is a Finviz filter that you could use to identify such companies. | FINVIZ Filters (Compressing Margins) | Fundamentals | Operating Margin: Below 5% Gross Margin: Below Industry EPS growth (Past 5Y): Negative

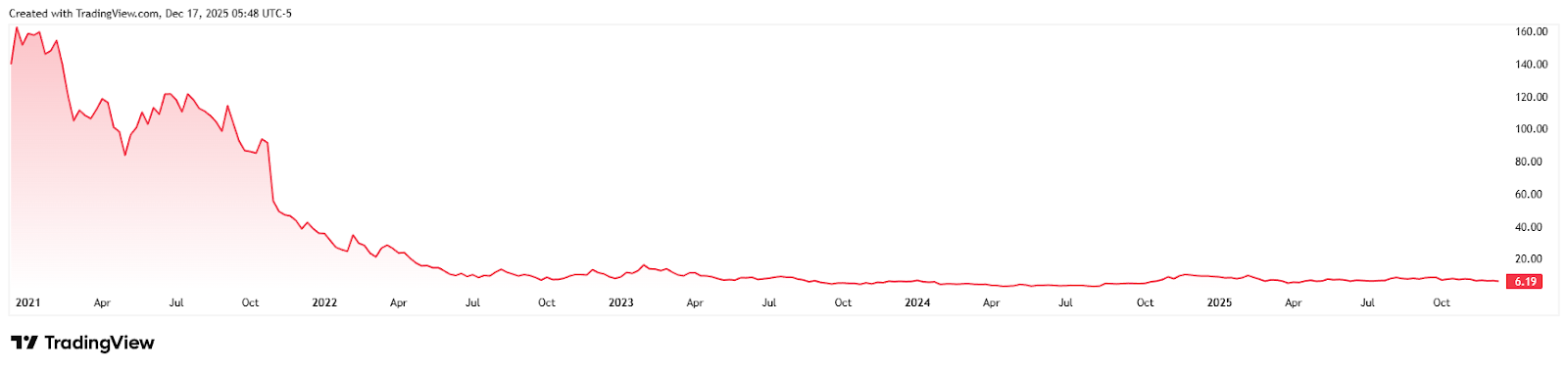

| Performance | | Peloton Interactive Inc. (PTON) 's performance from 2021 to 2022 serves as a great example. Their revenue held up briefly, but cash burn destroyed their gross margins, which collapsed from 50% to negative in just a few years. |  | Last five years ' stock price of Peloton Interactive Inc. (PTON) |

|

|

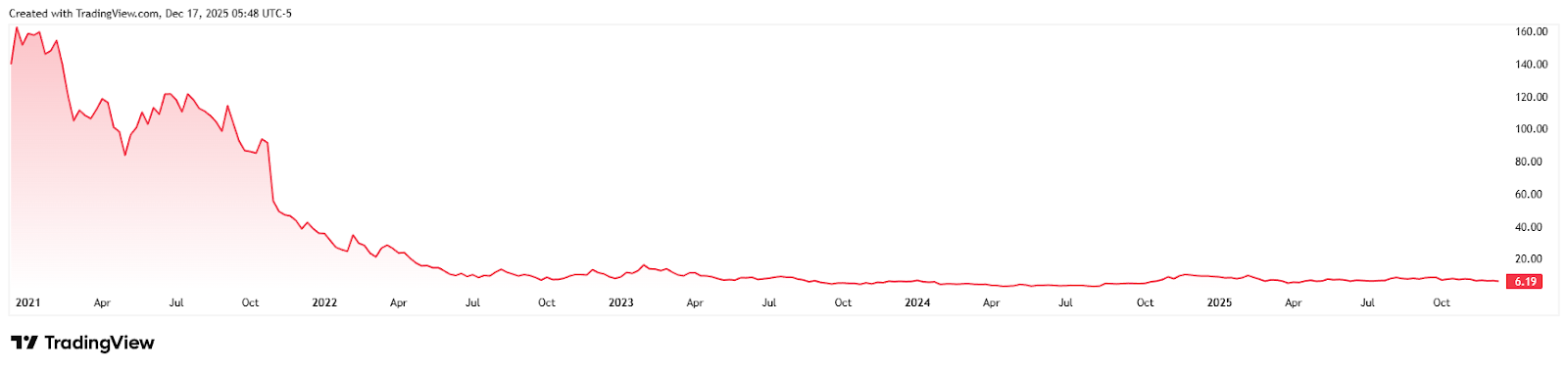

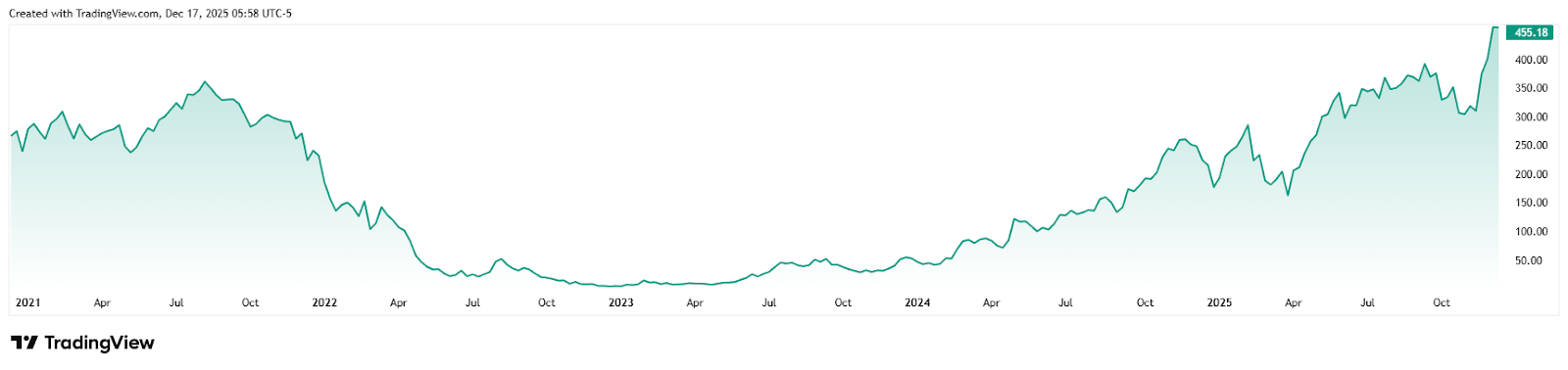

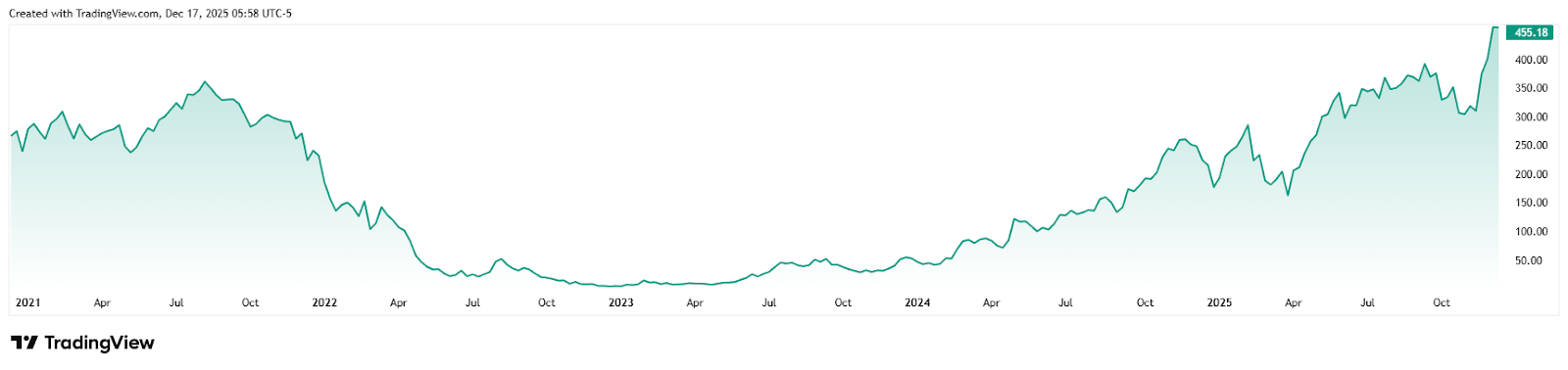

| | Value Trap 3: Cash Flow Issues | The balance sheet, not valuation, is setting the timeline. These firms have strong valuation and potential, but the cash flow crunch can be the deciding factor in whether they become a value trap. | FINVIZ Filters (Cash Flow) | Fundamentals | | Balance Sheet | | Carvana (CVNA) plummeted 99% from its peak of $370 in August 2021 to approximately $3.72 by December 2022. Despite positive valuations, massive CAPEX spending and debt nearly led to bankruptcy. Carvana successfully negotiated a deal with creditors in 2023 to restructure $1 billion in debt. |  | Last five years ' stock price of Carvana (CVNA) |

|

|

| | Value Trap 4: Reducing EPS | Earnings Per Share (EPS) is one of the key numbers to consider when evaluating firms that fall under the value trap, as they consistently miss analyst estimates. The falling estimates signal future multiple compression. | FINVIZ Filters (EPS decline) | Earnings | EPS growth (Next Year): Negative EPS growth (This Year): Negative EPS Surprise (Last Q): Negative

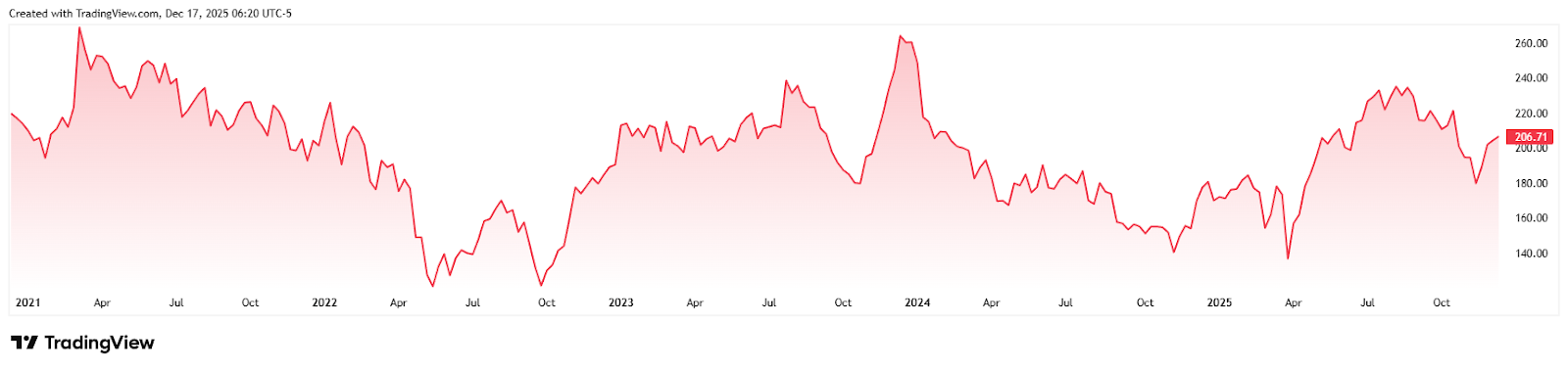

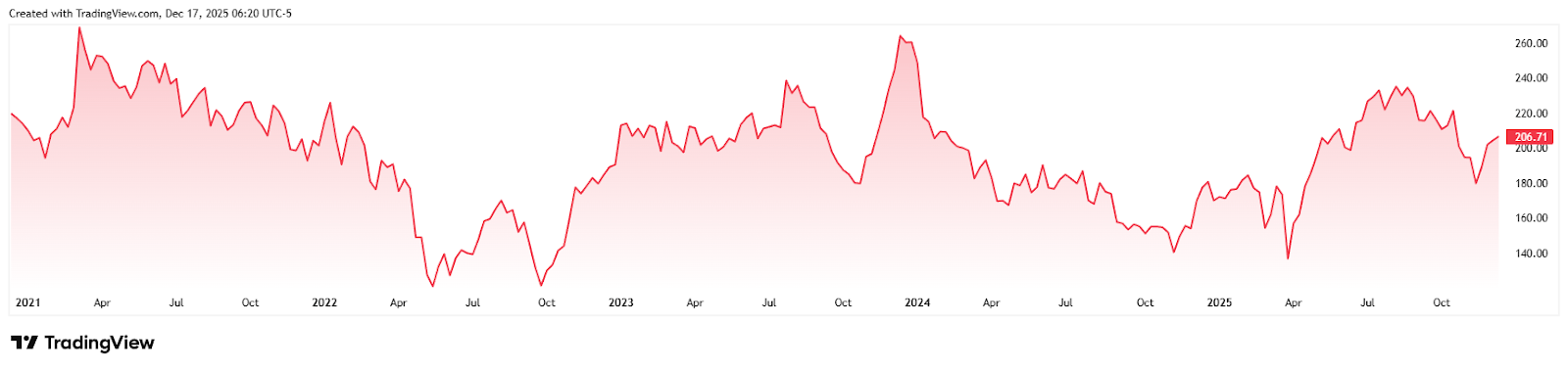

| Analyst Signals | | Boeing (BA) can be considered a suitable example for this category. Investors believed BA was part of the Duopoly, with assured long-term demand, and that EPS would rebound. However, it consistently failed to meet the estimates and was an underperformer against the benchmark. |  | Last five years ' stock price of Boeing (BA) |

|

|

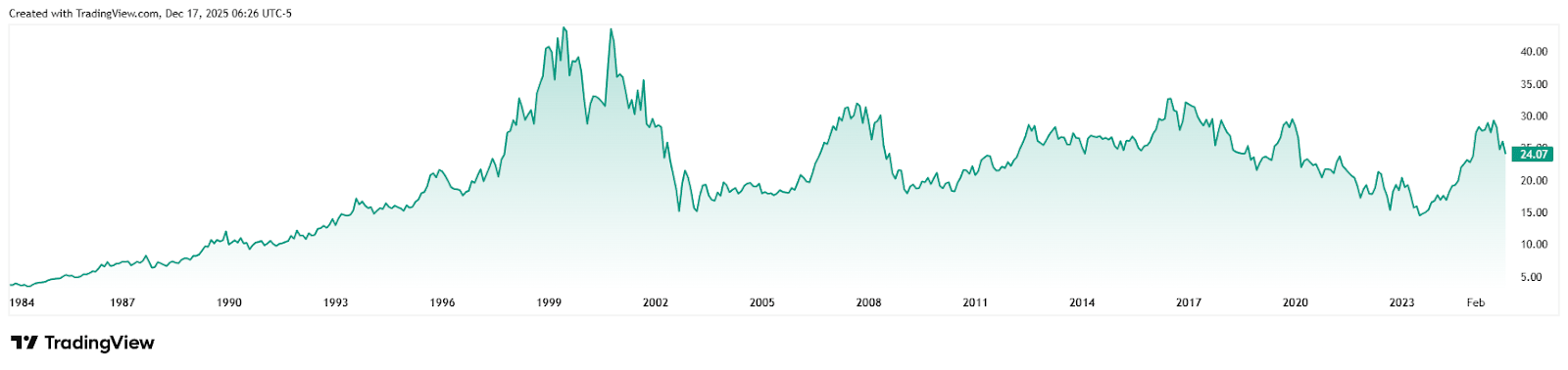

| | Value Trap 5: Debt-Laden | Having a high debt-to-equity ratio is not a significant issue; however, it becomes a problem if leverage restricts flexibility at precisely the time the business needs it most. Debt doesn't care about a company's valuation; it only cares about whether you have sufficient liquidity. | FINVIZ Filters (Debt-Driven) | Balance Sheet | | Performance | | AT&T (T) 's past performance fits the bill. The prevailing sentiment among investors regarding this stock is "Safe dividend, cheap multiple, and stable business." However, they had massive debt from 2017 to 2022 due to the acquisitions and strategic reversals, such as the failure of Time Warner. Stock massively underperformed the market for years. |  | Last five years ' stock price of AT&T (T) |

|

|

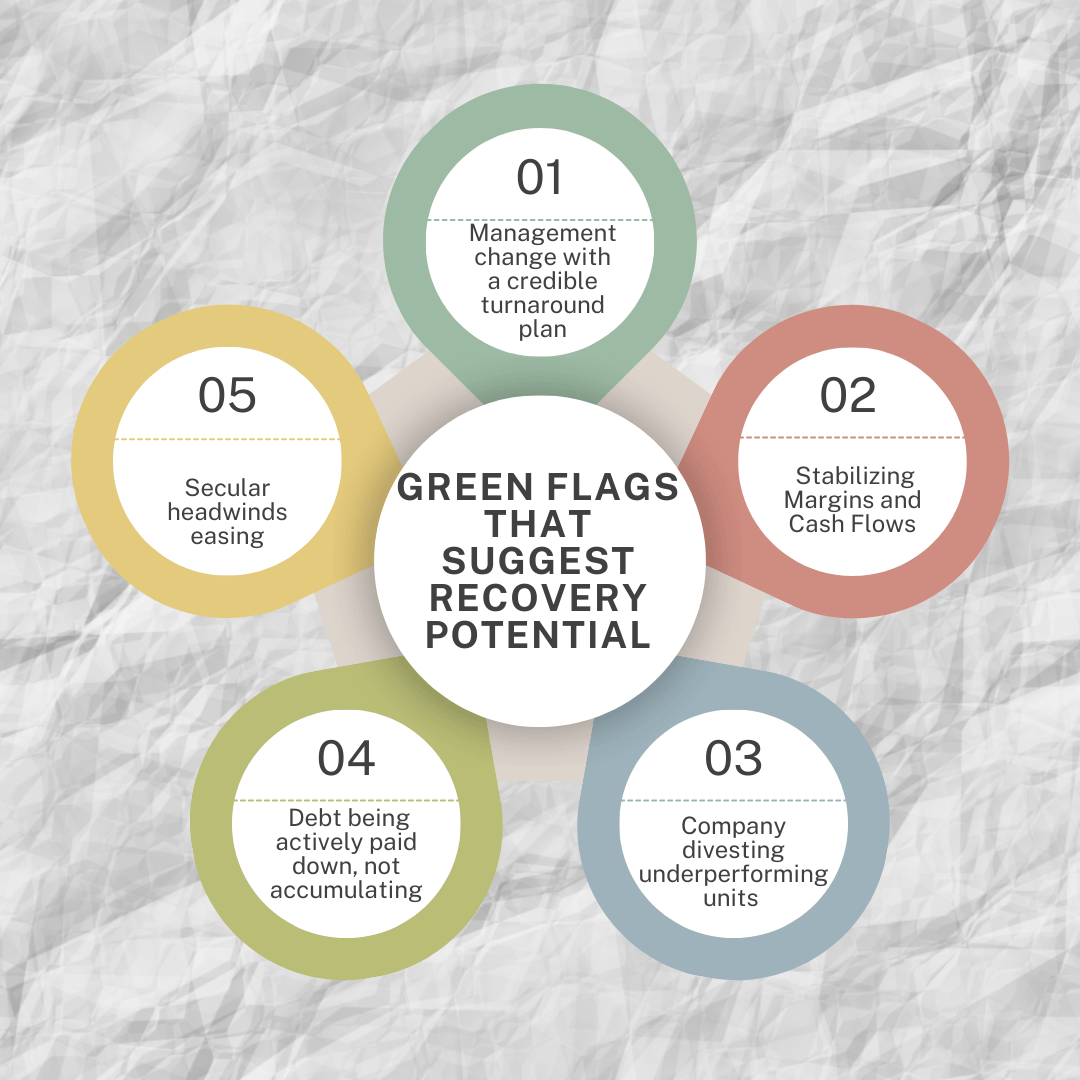

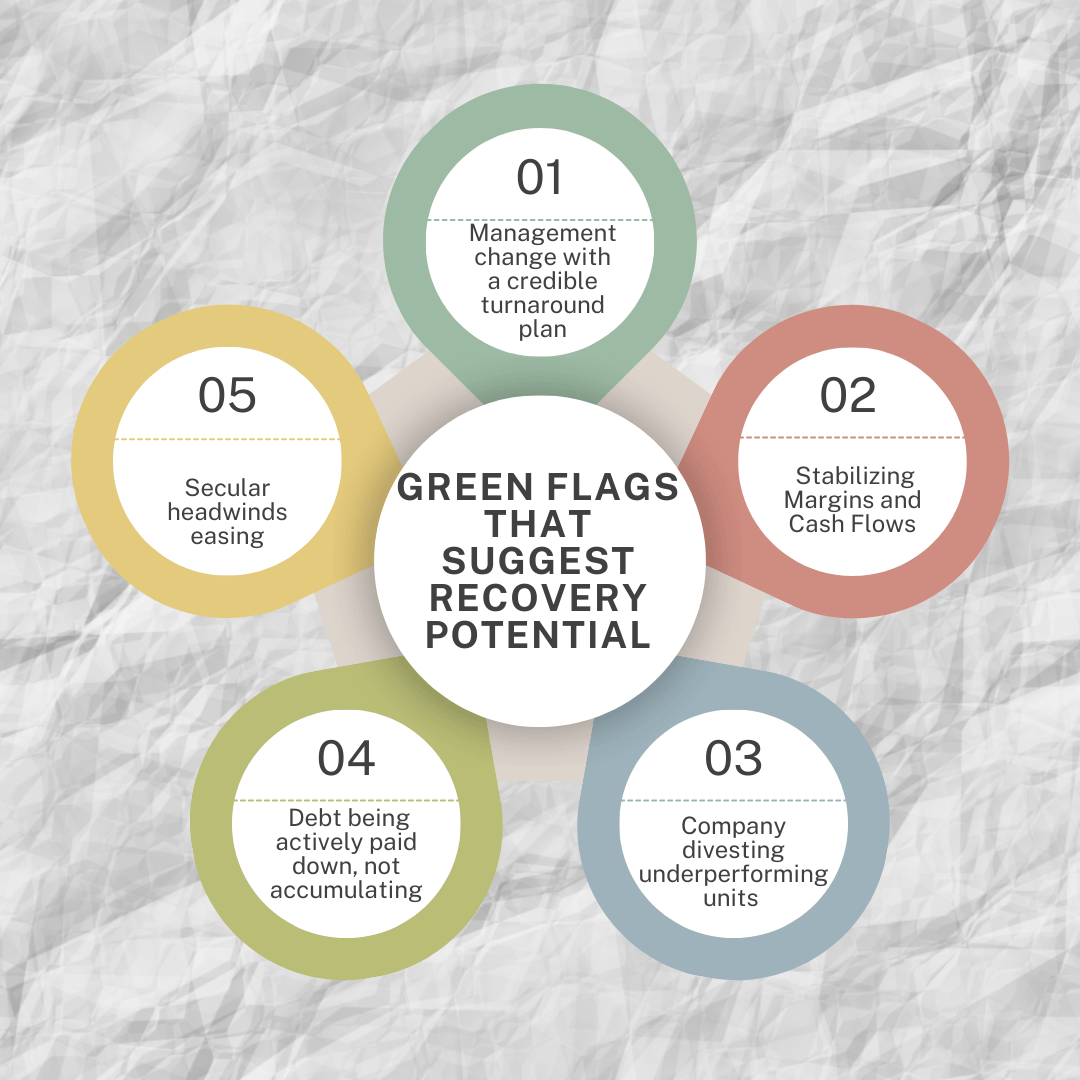

| | When a Beaten-Down Stock ISN'T a Trap | Not every declining stock is a value trap. Some are genuine turnaround opportunities. Here's how to tell the difference: | Green flags that suggest recovery potential: |  | Green Flags to look for |

| The key difference: In a turnaround, you see improvement in the fundamentals. In a value trap, you see continued deterioration that cheap valuations can't fix. |

|

| | What To Do Right Now | 1. Screen your portfolio using the FINVIZ filters above. Be honest about what you find. | 2. For each position that flags: Ask yourself, "Am I holding this because the business is improving, or because I'm down and hoping it recovers?" Hope isn't a strategy. | 3. Tax-loss harvesting works both ways: If you're sitting on a genuine value trap, selling it for a tax loss isn't giving up—it's accepting reality and redeploying capital to better opportunities. | 4. Don't rush into "bargains": Just because a stock is down 50% doesn't mean it can't go down another 50%. Make sure you understand why it's down before assuming it's oversold. | 5. Give yourself time: Real turnarounds take quarters or years, not weeks. If you can't explain why the fundamentals will improve over the next 12+ months, you're speculating, not investing. |

|

| | The Bottom Line | Tax-loss season creates opportunities, but most beaten-down stocks are down for good reasons. The market isn't always efficient in the short term, but it's pretty good at identifying broken businesses over time. | A cheap stock isn't a bargain if the business is deteriorating. Run the filters. Check the fundamentals. And be willing to accept that sometimes the market is right and you were wrong. | Your December portfolio review could save you from another painful year of holding value traps. |

|

| | | | | Important disclosures: This newsletter is provided for informational purposes only and does not constitute investment advice. All investments involve risk, including possible loss of principal. Please consult with your financial advisor before making investment decisions. |

| |

| | |

|

|

No comments:

Post a Comment

Keep a civil tongue.