| TQ Morning Briefing | The tape is still holding risk. But the system is repricing politics, alliance stability, and long-end funding as live inputs. | | | | | | Risk Still Holds, But The Market Is Quietly Repricing The West | This morning isn't about a single catalyst. | It's about the market realizing that what used to be "background stability" is now an active variable. | AI capex is still moving. Credit is still functioning. Earnings are still the nearest-term scoreboard. | But the geopolitical container just cracked open in a new way. | The U.S. is no longer being priced as a stabilizer for Europe. | It's being priced as a source of coercion risk. | That matters because the modern tape is built on one premise: the system stays legible even when outcomes are noisy. | If credibility becomes conditional, the market doesn't wait for the consequences to show up in data. | It front-runs them in term premium, FX hedges, and global risk appetite. | So equities can still hold posture while something else tightens. | The market is not panicking. | It is re-architecting its assumptions. |

| |

| | |

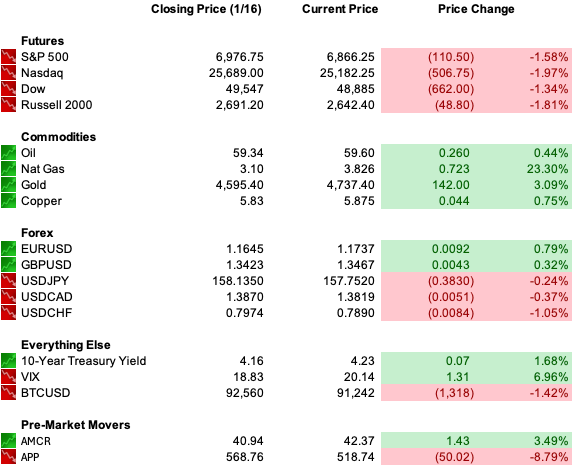

| | | | | | | WHAT'S ACTUALLY MOVING MARKETS |

| |

|

| | | Greenland Turned Europe From Ally Risk To Counterparty Risk | The Greenland dispute is not being priced like diplomacy. It is being priced like precedent. | Tariffs as leverage are one thing. Tariffs to force territorial outcome are something else. | That changes the psychological map inside Europe. | Europe's near-term priority is still to de-escalate. | But the bigger shift is that decoupling is now being openly discussed, not as a policy ambition, but as a long-term requirement. | Even if it is expensive. Even if it is slow. Even if it is politically painful. | That is the escalation the market cares about. | Once alliances become transactional, they become tradable. | And once they become tradable, funding costs and capital flows start to behave differently. |

| |

| | |

| | | Tariffs Are Moving From Economic Tool To Geostrategic Weapon | This is not a normal trade-war playbook. This is tariffs being used as a substitute for force. | Markets can model the impact of a 10 percent tariff. They struggle to model the impact of a doctrine shift. | The key is asymmetry. | It is easier to coerce small partners than large rivals. | And it is easier to coerce through trade than through formal security treaties. | That is the line the market is now drawing. | Policy is not a forecast. Policy is a variable. | And that mechanically tightens financial conditions without a single Fed hike. | Because the cost isn't interest rates. | It's uncertainty attached to the rules of engagement. |

| |

| | |

| | | The Long End Is Reacting Because Credibility Is The Real Input | The U.S. curve is doing what it always does in credibility episodes. | The long end lifts first. | Not because inflation is reigniting on its own. Because term premium is becoming a political premium. | When investors start to worry that institutions can be bent, pressured, or rewritten, the long end stops being a clean macro expression. | It becomes a durability expression. | That is why the Fed independence fight is not a legal headline. It is a rates regime headline. | The Supreme Court hearing tied to Lisa Cook is being watched as a test of whether independence has any enforcement power, or whether it is simply a norm that can be dissolved. | If the market concludes that independence is discretionary, duration becomes more expensive to own. | Not because rates must rise. Because the hedge stops being pure. |

| |

| | |

| | | Global Bonds Are Selling Off For The Same Reason | Japan's long end is blowing out.

Europe's long end is pushing higher.

The U.S. long end is following. | The shared driver is not one country. It is the same structural shift. | Major governments are living in deficits. Debt loads are heavy. Issuance is constant. | And now geopolitics is adding a new layer: defense spend, industrial policy, and strategic competition. | Japan matters because it has been one of the largest marginal buyers of foreign sovereign paper, especially U.S. Treasurys. | If domestic yields keep rising, Japan's capital becomes more likely to stay home. | That is a quiet pressure point on U.S. funding. | So the long end is not just repricing growth. | It is repricing who absorbs supply. |

| |

| | |

| | | | | | The Tape Is Still Risk-On, But It's A More Expensive Kind Of Risk-On | Equities can still grind. AI can still lead. Credit can still behave. | But the flow behavior is changing. | The market is narrowing around what can function under interference. | It rewards businesses with control over bottlenecks.

It rewards pricing power that does not require political calm.

It rewards systems that can clear even if the rules keep shifting. | That is why hedges refuse to cheapen even when indices hold near highs. That is why gold stays firm. That is why the long end stays sensitive. | This is not a fear tape. It is a conditional tape. | And the condition is that institutional credibility is no longer assumed. |

| |

| | |

| | | | Europe's Pushback Is A Capital Flow Story, Not Just A Diplomatic Story | The biggest risk is not that Europe retaliates with tariffs. | The bigger risk is that Europe begins to treat the U.S. as a less reliable repository for savings and security. | Europe has been one of the deepest external lenders to America. | If that begins to shift at the margin, the market pattern changes. | Equities down.

Dollar down.

Yields up. | That is the "sell America" mix. Not anti-growth. Anti-unpredictability. | We are not there yet. | But the Greenland episode moves the topic from theoretical to discussable. And the market doesn't wait for a policy memo to adjust. | It adjusts when behavior becomes plausible. |

| |

| | |

| | | | The System Is Repricing Political Credibility Faster Than Economic Reality | This is the new operating rule. | The market used to treat politics as theater and economics as truth. | Now politics can move the discount rate faster than fundamentals can move earnings. | That is why Europe's relationship with the U.S. matters even if tariffs never fully land. | Because the risk isn't the tariff rate. It's the proof that they can be used for anything. | Once that is proven, the next move doesn't need to be rational. | It just needs to be possible. | So the tape stays supported. | But the cost of participation rises. | Not in volatility spikes. | In hedging premiums, duration sensitivity, and higher required confidence. |

| |

| | |

| | | | The "Mandatory Payout" Law - 26 UvS. Code § 857 | There is a special class of company legally required to pay out 90% of profits... They're forced by 26 U.S. Code § 857. And right now, a specific group of these companies is perfectly positioned to profit from a new decision by President Trump. | A former Presidential Advisor explains how to get in on these "Mandatory Payout" stocks in his latest briefing... | Click here to get the name and ticker of his #1 "Mandatory Payout" stock to buy now, FREE |

| |

| | |

| | | | Data: ADP Weekly Employment Change

Earnings: Netflix (NFLX), 3M (MMM), US Bancorp (USB), DR Horton (DHI), Fastenal (FAST)

Overnight: Nikkei -1.11%, Shanghai -0.01%, FTSE 100 -1.07%, DAX -1.63% |

| |

| | |

| | | | | | The market is still holding risk because growth is still alive and the AI buildout is still funded. | But it is repricing the system around it. | Tariffs are no longer just trade. | They are leverage. | And leverage changes how credibility gets priced. | The tape isn't breaking. | It's recalibrating what it takes to stay long. | This is a growth market with a political premium. | If you understand that, you stop arguing headlines and start tracking the funding variables that move first. |

| |

| | |

|

|

No comments:

Post a Comment

Keep a civil tongue.