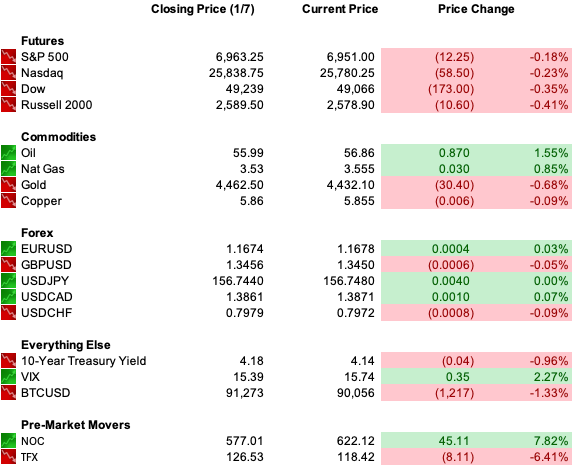

| TQ Morning Briefing | Policy moved first. Markets stayed selective. | | | | | | Policy Noise, Economic Gravity | This is what a market looks like when politics gets louder but price discovery refuses to follow immediately. | U.S. futures are lower across the board after yesterday's pullback from record highs. The Dow and S&P are pointing modestly down. The Nasdaq is softer again. | Rates are steady. Oil is flat to lower. Metals are sliding. Volatility remains contained. | Nothing here suggests disorder.

Nothing here suggests chase. | What changed overnight was not sentiment. It was tolerance. | Markets are no longer reacting to geopolitical shock. They are reapplying filters as policy intervention becomes more explicit and more frequent. | That distinction matters, because it tells you this is not fear-driven de-risking. It is standards tightening. | Yesterday's selloff broke a short opening rally, but it did not unwind positioning. This morning's price action confirms that interpretation. Risk is being tested, not rejected. |

| |

| | |

| | | | What Happened to the US Dollar? | In 1950, one U.S. dollar was worth 100 cents. | Today, that same dollar is worth about 3 cents — and Washington keeps printing more. | That loss didn't happen overnight. It happened quietly, year by year. | While people worked, saved, and planned for retirement, inflation steadily took its share — eroding purchasing power along the way. | What are you worth when the dollar reaches zero? | At Revelation Gold Group, we help Americans protect what they've spent a lifetime building — before more is lost. | Get our free 2026 Wealth Protection Guide and a no-cost consultation |

| |

| | |

| | | | | WHAT'S ACTUALLY MOVING MARKETS |

| |

|

| | | Defense Became a Managed Trade | The headline number was enormous. A proposed $1.5 trillion defense budget would normally read as a clean tailwind for the sector. | The market did not treat it that way. | Defense equities rallied premarket, but the enthusiasm is capped by the same force that lifted them. | The administration is no longer just expanding demand. It is asserting control over capital allocation. | Restrictions on buybacks, dividends, and executive compensation reframed defense from a free-cash-flow story into a politically governed one. | That shift matters more than the budget figure. | Markets can price spending. They struggle to price discretion. Defense is being repriced as policy infrastructure rather than shareholder infrastructure. | That produces volatility, not conviction. | Oil Refused to Play Along | If U.S. control of Venezuelan oil were a scarcity shock, crude would not be sitting near $60. | It is. | That tells you everything. Oil is being priced as administrative flow, not as an incremental supply impulse. | Sanctions mechanics, storage, transport, refinery compatibility, and political sequencing matter more than reserve size. Until those clear, barrels are theoretical. | This is why refiners continue to look better than producers. Heavy crude access is valuable over time, not overnight. The market is refusing to prepay for execution risk. | The signal is not indifference.

It is patience enforced by process. | Metals Unwound on Mechanics, Not Meaning | Gold and silver are selling off sharply, but the reason is visible and contained. Commodity index rebalancing and a firmer dollar are doing the work. | There is no disorderly unwind. No credit spillover. No volatility shock. | Last week priced geopolitical insurance. This week is resizing it. The market is not abandoning hedges. It is recalibrating them now that escalation looks staged rather than abrupt. | Late-cycle markets do not abandon protection.

They right-size it. |

| |

| | |

| | | | 10 AI Stocks to Lead the Next Decade | AI is fueling the Fourth Industrial Revolution – and these 10 stocks are front and center. | One of them makes $40K accelerator chips with a full-stack platform that all but guarantees wide adoption. | Another leads warehouse automation, with a $23B backlog – including all 47 distribution centers of a top U.S. retailer – plus a JV to lease robots to mid-market operators. | From core infrastructure to automation leaders, these companies and other leaders are all in The 10 Best AI Stocks to Own in 2026. | Free today, grab it before the paywall locks. |

| |

| | |

| | | | The Donroe Doctrine Is a Volatility Source, Not a Regime Shift Yet | Between Venezuela, Greenland, housing, defense, and trade, the administration is widening the policy surface area rapidly. | Markets are responding selectively. | Housing rhetoric hit homebuilders and rental REITs hard, but did not leak into credit. | Defense absorbed the budget shock but balked at capital controls. Energy shrugged off geopolitical escalation entirely. | That divergence matters. | Markets are distinguishing between authority and enforceability. Until policy translates into durable legal and economic frameworks, capital will continue to price optionality rather than outcomes. | Prediction markets are racing ahead of equities. Diplomats are reacting faster than traders. | That gap tells you markets still believe escalation, if it comes, will be sequenced and absorbed rather than forced. |

| |

| | |

| | | | Where Capital Is Still Willing to Sit | The most important signal this morning is not what sold. It is what stayed held. | Rates remain orderly. The dollar is firm but not disruptive. Credit is calm. Volatility is compressed. | Capital is still willing to sit in exposures where outcomes are governed rather than speculative. | Defense is tolerated because demand is policy-backed, even if returns are capped. | Refiners are held because infrastructure exists even if barrels lag. | Select AI exposure remains supported where demand converts into installed reality rather than narrative. | By contrast, assets that depend on immediate political execution were told to wait. | This is not fear.

It is filtration. | Markets are deciding what they are willing to tolerate next, not what they need to escape from. |

| |

| | |

| | | | How to Claim Your Stake in SpaceX with $500 | | Every week Elon Musk is sending about 60 more satellites into orbit. | Tech legend Jeff Brown believes he's building what will be the world's first global communications carrier. | He predicts this will be Elon's next trillion-dollar business. | And when it goes public, you could cash out with the biggest payout of your life. | Click here to get the details and learn how to claim your stake starting with just $500. |

| |

| | |

| | | | Data: Balance of Trade, Initial Jobless Claims, Nonfarm Productivity

Earnings: RPM International (RPM), SYNNEX (SNX)

Overnight: Nikkei -1.63%, Shanghai -0.07%, FTSE 100 -0.17%, DAX -0.08% |

| |

| | |

| | | | | | Control Is Still the Theme | This is not a market losing confidence.

It is a market demanding proof. | Policy is visible. Intervention is rising. But capital is still governed by rates, cash flows, and execution timelines. Headlines are being processed, not chased. | Some upside will stall.

Some volatility will persist.

Some narratives will fail to clear the bar. | That is the cost of control. | The system is not accelerating.

It is not breaking.

It is deciding how much discretion it is willing to absorb before repricing risk. |

| |

| | |

|

|

No comments:

Post a Comment

Keep a civil tongue.